Sponsored by Sideways Frequency*

monday June 30, 2025

US GOLD CORP (Nasdaq: USAU)

👉 USAU is TODAY’S #1 ALERT 👈

Hey there, Folks,

One of the biggest stories so far this year has been the decline of the U.S. dollar, which just reached its lowest level in more than three years.

Reuters notes that the market is now focused on “a slew of U.S. jobs data due later this week that could influence the Federal Reserve’s rate cut trajectory.”

That’s driving gold higher to start the week.

Which brings me to a “tactical trade” idea for today…

This one has been on an absolute rip this year — but I think it still has big-time upside.

💥Have a look at the chart for U.S. Gold Corp. (USAU).

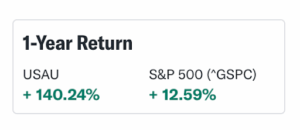

Over the past year, it has soared 140% – handily crushing the returns on SPY, and most other miners for that matter…

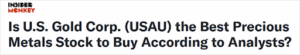

On April 25, this article asked:

It concluded that “Overall, USAU ranks 2nd on our list of best precious metals stocks to buy according to analysts.”

The stock is up nearly 30% from its low that day.

However, if you examine its chart, you’ll see that the stock spiked above $14 in early June and is now consolidating around $12, potentially forming a new support base.

If that support holds, bulls may target a move back toward the $14 resistance level, especially if gold prices remain firm or rise further.

The stock was just included in the Russell 2000 as part of the index’s June 27 reconstitution, which should lead to significant institutional visibility and buying pressure.

After a 6% pullback on Friday, I’m watching USAU for a big bounce-back today, as gold is once again catching a big bid higher.

👉 USAU is TODAY’S #1 ALERT 👈

The company clearly has a lot going for it. Let me explain…

U.S. Gold Corp is a “U.S.-focused gold exploration and development company advancing high-potential projects in Wyoming, Nevada, and Idaho.”

As I’m sure you’re aware, gold has performed exceptionally well over the past 12 months. It’s up 40% to $3,288 an ounce, though it has flirted with $3,500 a few times this year.

But as an astute mathematician, I’m sure you’ve calculated that the 133% gain of USAU over the past 12 months is more than three times that 40% climb in the price of gold.

That’s why I love gold mining stocks over gold itself — the potential for outsized gains. And these junior miners can especially move.

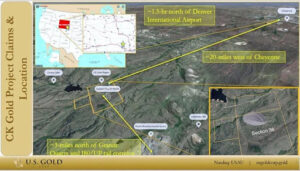

USAU has several “shots on goal” but its crown jewel is the CK Gold Project, a gold-copper deposit near Cheyenne, Wyoming just 1.5 hours north of the Denver International Airport.

The project is situated near major highways and rail and has been in the works for years.

But on February 11, the company released an updated Preliminary Feasibility Study (PFS) for CK Gold. The new PFS estimates:

- “Average gold equivalent (AuEq) production of 1,112,000 AuEq ounces over the mine life, or 111,250 AuEq ounces per year, assuming a 10-year mine life.”

- “Base case Net Present Value (“NPV”) of $459 million (pre-tax), at a discount rate of 5%, and Internal Rate of Return (“IRR”) of 36.0%, each based on price assumptions of $2,100 per ounce of gold, $4.10 per pound of copper and $27 per ounce of silver.” (Very conservative price estimates!)

- “Mineral Reserves of 1.672 million AuEq ounces, supporting an eight-year mine life and 10 years of processing. This includes 1.022 million ounces of gold, 259.7 million pounds of copper, and 3.008 million ounces of silver.”

All told, compared to the prior PFS study, the project payback improved 15%, the NPV improved 42%, and the AuEq ounces increased 16%.

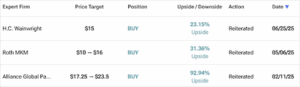

These improvements have led analysts to reiterate or ramp up their price targets for USAU this year:

USAU says CK Gold Project has obtained all major permits and is “ready for development pending county planning, building and fire inspections during construction.” This de-risks the project significantly.

Clearly, there is reason for substantial optimism ahead of a full feasibility study expected later this year.

And just last week, the company revealed it had contracted Micon International Limited and Halyard Inc. “to conduct the next phase of engineering leading to the development of the Company’s wholly owned CK Gold Project.”

Beyond CK Gold, U.S. Gold holds the Keystone Project in Nevada, an early-stage gold exploration play on the Cortez Trend near major producers such as Barrick and Newmont, and the Challis Gold Project in Idaho, another exploration asset with historical mineralization.

These are less advanced but add upside potential to the company’s portfolio.

USAU is headed by President and CEO George Bee, who the company says “has managed multiple world-class mining projects in 8 countries for major and junior mining companies. He has taken several mines from development to production and recently was a Sr. VP for Barrick Gold.”

Financially, USAU raised $10.2 million in a December 2024 direct offering, keeping its share structure tight and dilution low — key for a junior miner.

Lastly, I’ll mention that President Trump’s pro-mining stance — which includes “drill, baby, drill” deregulation and tariffs favoring domestic metals — puts a tailwind at USAU’s back.

Trump has proposed copper tariffs, and as we saw, USAU is sitting on 260 million pounds of it at the CK Gold Project alone.

As you do your own research on this stock, be sure to check out this pleasantly accessible investor presentation released in May, this webinar covering the latest PFS study, and the company website.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: USAU has been on a rocket ride 🚀 — up 140% over the past 12 months and 97% in 2025 alone.

With gold surging on the dollar’s weakness, and lots of jobs data due out later this week, I’m staying glued to USAU to see if it bounces higher today.

💥Lock in to USAU to watch the price action unfold!

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from Sideways Frequency for advertising U.S. Gold Corp for a one day marketing program on June 30, 2025. Prior to this, we received fifteen thousand dollars (cash) from Sideways Frequency for advertising U.S. Gold Corp for a one day marketing program on April 28, 2025, and we also received thirty five thousand dollars (cash) from Sideways Frequency for advertising U.S. Gold Corp for a one day marketing program on February 19, 2025, and we also received eight thousand dollars (cash) from Sideways Frequency for advertising U.S. Gold Corp for a one day marketing program on December 23, 2024 and also ten thousand dollars (cash) from Sideways Frequency for advertising U.S. Gold Corp for a one day marketing program on December 10, 2024. Previously, we were compensated fourteen thousand dollars by ach bank transfer by Lifewater Media for advertising US Gold Corp. from a period beginning on April 19, 2023 through April 20 of the same year. Previously, RagingBull has been paid fourteen thousand dollars by ach bank transfer by Lifewater Media for advertising US Gold Corp. from a period beginning on March 27, 2023 through March 28 of the same year. It might seem obvious, but while our client claims not to own any shares in U.S. Gold Corp, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into U.S. Gold Corp might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.