Disseminated on behalf of PowerBank Corp (NASDAQ: SUUN)

Tuesday November 18 , 2025

PowerBank Corporation (Nasdaq: SUUN)

👉SUUN is TODAY’S #1 ALERT👈

Hey Folks, Jeff Bishop here,

Stocks took a dive yesterday as investors soured on the AI trade ahead of Wednesday’s NVDA earnings.

The markets are also nervous about the Fed’s October minutes on Wednesday and the September nonfarm payroll release on Thursday.

Thankfully, my “tactical trade” idea from yesterday bucked the trend. Just a few hours after my alert, here’s how it looked:

There weren’t many stocks moving in that direction yesterday, Folks.

Today I’m taking aim at a company that posted excellent earnings yesterday.

💥Go ahead and pull up PowerBank Corp (SUUN) on your trading platform.

The company is a small-cap renewable energy developer focused on community solar, battery storage, and EV infrastructure in North America.

Yesterday, it released Q1 2026 earnings for the three months ending September 30, 2025…

The results were unambiguously positive for a company that had been burning cash. The headline was a “return to profitability.” Some highlights (all figures in CAD):

- A gross profit of $8.54 million, or 44.62% of revenues, compared to $4.14 million, or 27.47% of revenues in the same quarter for 2025.

- Adjusted EBITDA of $4.84 million compared to $1.97 million for the first quarter of FY2025.

- Revenues were $19.15 million compared to $15.06 million in the same period during FY2025.

- Net income of $1.01 million, or $0.03 per basic share in the first quarter of FY2026, compared to a net loss of $26.49 million, or $(0.87) per basic share during the same quarter in FY2025.

Analysts expected earnings of ($.05) per share and revenue of $14 million for the quarter.

Instead, the company reported positive EPS and revenue of $19 million.

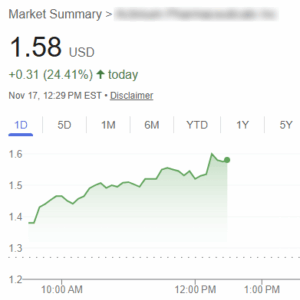

As a result, the stock gapped up in the pre-market and climbed 12% by 11:00 AM.

It stayed on that higher plateau until 1:30 PM, when selling pressure crept in.

So while we got an initial surge on the headline beat, into the close we saw profit-taking as investors “sold the news.”

The earnings call wasn’t scheduled until 4:30 PM, so holders may have been locking in gains ahead of commentary risks.

From what I can tell, there was no obvious negative surprise in the print or filings, or in the earnings call (transcript here), which appeared positive.

These post-earnings overshoots often reverse the next day or two once the dust settles, especially when the actual results were as good as these were.

No guarantees, of course, but with no surprises in the earnings call, I’m watching SUUN for a rebound today.

👉 SUUN is TODAY’S #1 ALERT 👈

SUUN says its “innovative power solutions are rooted in power generation, transmission, distribution, and energy services, creating a sustainable Independent Power Producer to fuel the digital economy.”

By the numbers, the company boasts:

- $10M+ Annual Recurring Revenue under government contracts

- $190M+ Total Assets

- 100+ Clean & Renewable Power Plants Under Management

- $300M+ Projects Financing Managed

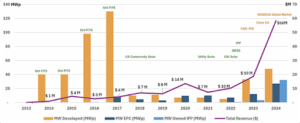

And even before yesterday’s earnings release, the company’s revenues had been on a solid growth trajectory:

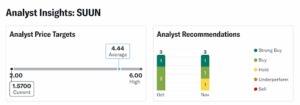

Analysts seem to be on board with the high-growth story as well.

As you can see, the average analyst covering the company has a price target that is over 180% higher than the current price.

As you do your own homework on SUUN, sure sure to review this August 2025 investor presentation, yesterday’s earnings-call transcript, and the company website.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from IR Agency for advertising PowerBank Corporation for a two day marketing program starting on November 18, 2025. Previously, we received forty thousand dollars (cash) from New Era Publishing for advertising PowerBank Corporation for a two day marketing program starting on June 16, 2025. Prior to this, we received forty thousand dollars (cash) from New Era Publishing for advertising PowerBank Corporation for a five day marketing program starting on March 09, 2025. To date, we have received ninety five thousand dollars for advertising PowerBank Corporation.

It might seem obvious, but while our client claims not to own any shares in PowerBank Corporation, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into PowerBank Corporation might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.