Sponsored by Sica Media and Disseminated on Behalf of SunCar Technology, Inc*

wednesday sEP 3 , 2025

SunCar Technology (Nasdaq: SDA)

👉SDA is TODAY’S #1 ALERT 👈

Hey Folks, Jeff Bishop here,

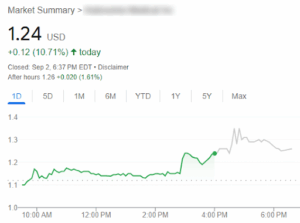

I was pleased to see that despite the markets dropping yesterday, one of my “tactical trade” ideas from closed the day up around 10%:

The stock I’m targeting today matched that performance, though the company is further afield…

Much like here in the U.S., Chinese stocks have been booming this year, buoyed by government stimulus, easing trade tensions, and positive policy reforms especially around media and tech.

Last month, the Shanghai Stock Exchange Composite Index reached its highest finish since August 2015.

My “tactical trade” idea today is a Shanghai-based company whose primary listing is on the Nasdaq.

💥Have a look at SunCar Technology Group Inc (SDA) on your trading platform.

The stock experienced a significant drop in early February due to a $50 million public offering.

It declined further into early April due to geopolitical worries and tariff headlines.

The stock has had some minor rallies from there but largely traded sideways…

Until last month. Since August 1, the stock is up 30%. It even managed to climb 9.6% as the markets bled yesterday.

The stock has done especially well since the announcement last Wednesday of a deepening partnership with intelligent EV manufacturer NIO, Inc. (NYSE: NIO).

I think it’s now at a level that deserves a very close look, especially with the momentum it has picked up.

👉 SDA is TODAY’S #1 ALERT 👈

SunCar says it is working with its 20 EV partners — including Tesla, BYD, Nio, Li Auto, Xiaomi, and XPeng — on “transforming the customer journey for car insurance and aftermarket services in China, the largest passenger vehicle market in the world.” [emphasis added]

The company “develops and operates online platforms that seamlessly connect drivers with a wide range of automotive services and insurance coverage options from a nationwide network of provider partners.”

Its cloud-based, AI-powered platforms act as a one-stop shop for Chinese car owners, offering everything from car insurance to roadside assistance to carwash and oil change appointments.

Here are the top 5 things to know:

1. Massive Network of Premier Vendors 🕸️

SDA has built relationships with some of the biggest names in the auto and EV world — from automakers like Tesla, BYD, Nio, Li Auto, and XPeng to insurance giants like Ping An, PICC, and Pacific.

It boasts an “Established ecosystem of 20 auto manufacturer partnerships, 1,480 enterprise customers, 48,000 auto service providers, and 85 insurance companies.”

This vendor ecosystem gives the company a massive edge: instead of being a single-player service, its industry-specific cloud is plugged directly into the supply chain, financial institutions, and service providers that power the entire industry.

2. Lightning Partnerships with EV Tigers 🤝⚡

SDA is partnering with the biggest names in the Chinese EV game:

- On June 30, SDA revealed it has teamed up with Chinese tech giant Xiaomi — often called the “Apple of China” — to build fully intelligent auto insurance for Xiaomi’s debut SUV. SDA said it “expects its business with Xiaomi to double in 2025.”

- On July 8, SDA announced it had entered “a new phase of strategic cooperation” with intelligent EV manufacturer, XPeng, to offer its owners “the most innovative auto insurance solutions available in China.”

- On August 27, SDA entered a “new stage of cooperation” with NIO ($15 billion market cap). “With the launch and strong sales of the ES8 and ONVO L90 models featuring advanced intelligent driving, ultra-fast charging, and luxury tech features, SunCar will continue to provide NIO car owners with the most innovative auto insurance solutions available in China.”

- This writeup cites other notable partnerships, including “expanded cooperation with BYD across 50 dealerships in East China, new SAAS solutions for Leapmotor, and service platform extensions for Tesla.”

3. Revenue Rocket 🚀

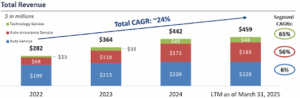

In May, SDA reported very impressive Q1 2025 earnings, including a 20% increase in year-over-year revenue to $102.6 million, as well as full-year 2025 revenue guidance of $521 million to $539 million, “reflecting forecasted revenue growth of 18% to 22%.”

These visuals show the company’s excellent growth trajectory:

4. Strategic Ecosystem Expansion — More Than Just Insurance 🌐

Here’s what SDA is building:

- Anji AI Service Center — “to co-develop [AI] insurance products with our auto partners and increase their new policies, renewals, and extended warranties sales.”

- Bank and insurer tie-ins — including China Construction Bank, PICC, and Ping An Insurance — which are meaningful vertical integrations.

- Smart car wash and concierge transportation services for the likes of Sam’s Club members and Agricultural Bank of China’s customers. Essentially, the company is turning retail auto services into a seamless digital experience that companies can brand as their own.

- Analyst See Big Upside Potential 📈

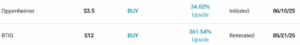

On June 2, shortly after SDA reported its Q1 earnings, Zacks Small Cap Research published a report that set a $12.00 price rating and concluded “We believe the stock to be significantly undervalued.” (It was trading for $2.76 at the time — just below its current price.)

And here are the two analysts cited by TipRanks:

As you do your own research, be sure to review this very accessible investor presentation from May as well as the investor website.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this report as well, so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: Despite its impressive earnings success, SDA was largely flat until August, when it began a 30% runup including its 9.6% move yesterday — a down day for the markets.

💥Stay tuned to SDA today to see where the momentum takes it!

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from Sica Media for advertising SunCar Technology, Inc for a one day marketing program starting on September 3, 2025. It might seem obvious, but while our client claims not to own any shares in SunCar Technology, Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into SunCar Technology, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.