Why Palantir (PLTR) Has Been Soaring — And What Traders Can Learn From It

Palantir (PLTR)’s earnings release yesterday fell short of sky-high expectations, ending (for now) a monster runup that was driven by AI hype, big government deals, and political tailwinds. Here’s what traders can learn from the breakout and the break-down.

Hey folks, Jeff Bishop here.

I’ve been having a ton of success over the last month identifying small-cap trade ideas that surged in spite of all the market turmoil.

I’ve also managed to lock in some great trades on some of the big(ger) boys too…

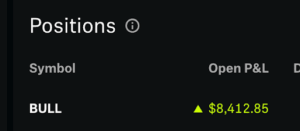

Like my Bullseye pick 🎯 from yesterday, BULL call options. I got a nice hit on the late-day run on that bad boy after taking a couple of small losses along the way:

*Note: Trading is hard, results not guaranteed and should not be expected to be replicated typically.

I also added a new position yesterday afternoon on USAR — one of my favorite stocks lately, and a play on rare earths, which could be in jeopardy as Trump negotiates with China.

I’m especially loving the hourly chart on that one.

One of the most interesting stocks lately — and one that’s been sitting high on my watchlist — is Palantir (PLTR).

It’s the best-performing stock in the entire S&P 500 in 2025 (up 64% YTD as of yesterday’s close), and what it did last month was especially crazy.

After dipping with the rest of the markets in the few days after President Trump’s “Liberation Day” announcement, the stock went on to rip 87% higher from its April 7 lows, far outpacing the major indexes.

As of yesterday’s close, it was sitting at $123.77 — more than 40% higher than its closing price before Trump’s announcement.

I had a very nice position on it from the $80’s, but I left $15+ on the table

The company released Q1 earnings after the bell, and despite beating revenue estimates and boosting full-year guidance, the stock fell nearly $10 in after-hours.

So, what is going on with PLTR? What has really driven all this price action, and more importantly, what can we learn from it?

The AI Gold Rush

First, the obvious: Palantir is at the forefront of two of the hottest trends in tech — artificial intelligence and government data contracts.

The company’s AI Platform (AIP) launched in April 2023 and is the big thing driving both revenue and investor excitement.

AIP is software designed to integrate large language models (LLMs) and other AI into business operations, enabling real-time, AI-driven decision-making.

It has defense, commercial, and government applications, and was rated the top AI and machine learning platform by Forrester Research.

In yesterday’s earnings, Palantir reported a 39% increase in Q1 revenue year-over-year.

Importantly, commercial revenue was up 71% from a year ago, compared to government revenue which was up just 45%.

That faster-growing commercial growth is good news for a company that has long been criticized for dependence on Uncle Sam.

Traders love a good growth story, especially when it’s tied to AI, which continues to be the hottest trend on Wall Street.

Strategic Partnerships

Palantir has also made some power moves with big tech allies. On April 23, it revealed an expanded partnership with Google Cloud.

It’s now offering a super-secure, government-friendly version of their software hosted on Google’s cloud.

That opens doors with federal agencies that need cloud AI services but have strict compliance needs.

When traders see a company like Palantir team up with a heavyweight like Google to expand their reach — it’s a green light. The stock jumped 14.6% by the closing bell on April 24.

Playing Politics

Like it or not, politics and stock prices are often entangled. And lately, Palantir has benefited from what’s been happening in Washington.

It’s no secret that Palantir co-founder Peter Thiel is a GOP megadonor.

I had a pretty good feeling that when the time came to dole out government contracts, his company would get a certain… preference.

That played out on April 18 — and certainly not for the first time — when Palantir won a $30 million no-bid contract “help Immigrations and Customs Enforcement agents build a sophisticated system to prioritize people for deportation.”

That’s on top of the company’s already existing $88 million contract with ICE.

* * *

Takeaways

Palantir’s run is a masterclass in spotting opportunity. Here are a few lessons:

- Strong narratives matter

Stocks don’t just move on fundamentals — they move on stories.

Palantir’s AI-driven transformation, its expansion into commercial contracts, and its alignment with political tailwinds create a compelling narrative.

When a stock has a “why now” story, it attracts attention and investment.

- Earnings catalysts are crucial

Palantir’s breakout didn’t happen in a vacuum. Their Q4 2024 quarterly earnings were a beat across the board, and that’s what kicked off the most recent run.

If after-hours trading yesterday is any guide, PLTR will be having a very bloody day today because investors didn’t think its stellar Q1 earnings were stellar enough.

It was wild to watch the stock initially jump 5% on the earnings news, only to meltdown a few minutes later.

Make sure you know when earnings are coming and have a clear game plan if you decide to trade around them.

- Look beyond the chart

Technical analysis is great, but the bigger picture matters.

If you’re just staring at candlesticks and moving averages, you might miss the partnerships, the policy changes, and the press coverage that moves markets.

Learn to read the news as closely as you read the charts.

* * *

Final Thought

PLTR’s April breakout shows where the market’s head is at: obsessed with AI, increasingly bullish on growth stories, and very much responsive to political signals.

Whether or not you’re trading PLTR directly, studying its rise can teach you a lot about timing, sentiment, and risk management.

It’s not about chasing the next rocket 🚀 — it’s about understanding why it takes off in the first place.

That’s how you trade smarter.

To Your Success,

Jeff Bishop