Sponsored by Legends Media and Disseminated on Behalf of NRx Pharmaceuticals, Inc*

Monday Aug 11 , 2025

NRx Pharmaceuticals (Nasdaq: NRXP)

👉NRXP is TODAY’S #1 ALERT 👈

Hey Folks, Jeff Bishop here.

There’s an urgent situation I’d like to bring to your attention…

If you follow developments in the biotech space, you know that psychedelic therapies for conditions like depression and PTSD are all the rage.

I’m focused on a stock right now that is prominent in this space, but that has also several very promising non-psychedelic potential sources of revenue in the queue.

💥Go ahead and pull up NRx Pharmaceuticals, Inc. (NRXP) on your preferred trading platform.

The company pursued some financing in January, and its stock price subsequently declined. But it had a very nice run-up beginning in April.

From its low on April 7 through its high on June 11, the stock surged 142%.

It has gradually pulled back from there, but it had big news out Friday that caused a jump, and more big news out this morning that I think could carry it higher today.

Nothing guaranteed, of course, but

👉 NRXP is TODAY’S #1 ALERT 👈

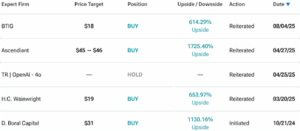

And while the stock has done well since April, analysts think it’s only getting started.

As you’ll see, none of this is surprising given the company’s huge progress.

NRXP is a clinical-stage biopharmaceutical company focused on developing therapies for central nervous system disorders, particularly suicidal bipolar depression, chronic pain, and PTSD.

Here are 5 reasons NRXP is catching the eye of investors:

1. Pioneering Treatment for Suicidal Bipolar Depression 🧠💊

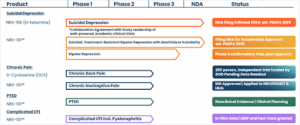

NRXP’s lead candidate is NRX-101, the first oral medication in FDA trials specifically targeting suicidal bipolar depression — a condition with no approved treatments to date.

It’s a “patented, oral fixed-dose combination of two FDA-approved drugs: D-cycloserine, an NMDA receptor modulator at certain dosage ranges; and Lurasidone, a 5-HT2a receptor antagonist.”

This drug has received Fast Track and Breakthrough Therapy designations from the FDA, highlighting its potential to address a critical unmet need.

The company says NRX-101 “remains on track for NDA submission under Accelerated Approval” and that it anticipates a PDUFA date (often a major catalyst for biotech stocks) in 2025.

2. Innovative Preservative-Free Ketamine Formulation 💉🧪

The company’s other key drug is NRX-100, a preservative-free IV ketamine formulation designed to treat suicidal depression. By eliminating preservatives like benzethonium chloride, which have been linked to neurotoxicity, NRX-100 aims to offer a safer alternative.

In April, the FDA granted NRXP a $4.3 million filing fee waiver for its New Drug (NDA) Application, recognizing its public health significance.

And on June 5, the company filed an Abbreviated New Drug Application (ANDA) with the FDA for NRX-100 “for use in all existing approved indications such as anesthesia and pain management.”

The big news out this morning is that NRX-100 was granted an FDA Fast Track Designation for suicidal ideation in patients with depression.

NRXP noted that “In a Columbia University study licensed by NRx, suicidal patients treated with intravenous ketamine demonstrated a 55% response.”

3. Expansion into Interventional Psychiatry Clinics 🏥🌐

Through its subsidiary, HOPE Therapeutics, NRXP is establishing a network of interventional psychiatry clinics across the U.S.

These clinics will offer treatments like ketamine therapy, transcranial magnetic stimulation (TMS), and digital therapeutics for conditions such as suicidal depression and PTSD.

The company notes that “Clinic acquisition financing is at the HOPE Therapeutics level and non-dilutive to NRXP shareholders.”

NRXP already has three initial clinic acquisitions lined up, and that it’s “aiming for $100 million in total, forward pro-forma revenue by year-end 2025.”

Just on Friday, NRXP announced that HOPE Therapeutics “received final clearance and approval from the Florida Agency for Health Care Administration (AHCA) to proceed closing of the Dura Medical LLC acquisition.”

It added that “Dura is revenue-generating and EBITDA positive.”

4. Strategic Financial Moves and Shareholder Benefits 💰📈

NRx has been proactive in securing funding, including a $7.8 million debt financing deal to support clinic acquisitions.

Moreover, the company announced plans to distribute shares of HOPE Therapeutics and royalty rights on ketamine sales as dividends to existing shareholders, potentially enhancing shareholder value.

5. Leadership with a Track Record of Success 👨⚕️🎯

Dr. Jonathan Javitt, the founder and CEO of NRx, brings a wealth of experience, having led drug-development engagements for Merck, Allergan, Pharmacia, Novartis, and Pfizer, and has been appointed to healthcare leadership roles under four U.S. Presidents.

His expertise in both the public and private sectors positions NRXP to navigate the complex landscape of drug development and commercialization effectively.

Final Thoughts

NRXP has generated considerable buzz…

Zacks Equity Research upgraded NRXP to a “BUY” in November 2024, and its stock has nearly doubled since then.

Here’s an article from March in Yahoo! Finance:

And the company was featured on Bloomberg TV on July 24.

Here is a page from the company’s website that links to research reports from four different analysts.

In May, the company said that its fundraising from January 2025 is “expected to provide sufficient cash to support operations through the end of 2025.”

As you do your own research on NRXP, be sure to take a look at the company website as well as this November 2024 presentation for Hope Therapeutics.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from Legends Media for advertising NRx Pharmaceuticals, Inc for a one day marketing program starting on August 11, 2025. It might seem obvious, but while our client claims not to own any shares in NRx Pharmaceuticals, Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into NRx Pharmaceuticals, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.

Get LIVE Commentary On Our Hottest Trades!