Retail investors crushed it in April 2025 — buying when hedge funds bailed and turning the chaos into gains. Here’s what went down…

April 2025 will go down as one of the wildest trading months in stock market history.

Global markets got absolutely rocked by President Trump’s “Liberation Day” announcement…

I’ll never forget watching the press conference live as the markets initially ticked up. Investors seemed relieved by what they saw.

But when the President held up his “Reciprocal Tariffs” placard, it became clear these tariffs were going to be way bigger than expected.

Photo credit: White House Instagram.

What followed was the biggest market nosedive since 2020.

The markets continued bleeding until Trump issued a 90-day pause on the “reciprocal tariffs,” which led to the biggest single-day rally in the S&P 500 since 2008.

And now, thanks also to the détente in the trade war with China, CNN reports that the S&P 500 “has now fully erased the year’s losses and gained nearly $8 trillion in market value since its April 8 lows.”

The portrait that has emerged since then is one of retail investors “buying the dip” as institutional investors for once have been left holding the bag.

On April 10, CNBC reported:

It noted that “institutional investors ran for the hills” during the week after Liberation Day. “But data from market insights firm Vanda Research, a trusted authority on retail investor trends, showed mom-and-pop traders… doing the exact opposite.”

On April 3, as the S&P 500 tanked nearly 5%, “self-directed retail investors pushed more than $3 billion into U.S. stocks on balance. … the largest daily net haul on record, per Vanda data going back to 2014.”

In total, between April 3 and April 8, “retail traders sent around $8.8 billion in net inflows to the U.S. stock market.”

They bought in on the way up too…

Bloomberg reported on J.P. Morgan data that showed retail traders “plowed a net $50 billion into US stocks” since April 8.

Meanwhile, big money panicked.

There was some speculation that foreign investors were the ones driving the flight from U.S. securities, but J.P. Morgan put that to rest, according to MarketWatch.

Some choice excerpts:

“The recent market sell-off has likely been driven by hedge funds reducing exposure to stocks and not a flight out of U.S. assets by foreign investors, according to JPMorgan.

“And when equities dived, it was retail investors who stepped in to pick up perceived bargains, the bank said.”

And

“Instead, JPMorgan said, much of the selling of U.S. equities in 2025 has been driven by equity-focused hedge funds, both discretionary and those with a bent for algorithmic trading, who have dumped about $750 billion of stocks year-to-date.

“ ‘Another key driver has been momentum-driven hedge funds… . We estimate their sales came to around $450 billion,’ said JPMorgan.” [emphasis added]

Now that the S&P 500 is in positive territory for the year, I’d like to play those hedge funds the world’s smallest violin 🎻.

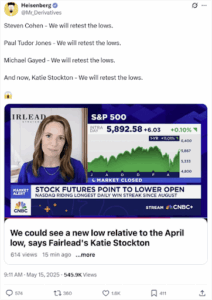

Retail investors are still optimistic, but some finance big wigs are throwing in with the bears:

We’ll see if they’re right! But for now, score one for the little guys 👍🏻.

Here are some lessons moving forward:

- Watch for more tariff escalation rhetoric — but don’t panic.

- Keep a close eye on U.S.-centric small caps; they’re moving on this stuff before anyone else.

- Stay tactical, not emotional. Focus on setups, not politics.

And most important: Don’t let Wall Street convince you you’re not supposed to win.

Because in April 2025, retail investors didn’t just survive the storm — they navigated it better than the pros.

To Your Success,