Sponsored by West Coast Media*

Thursday May 15 2025

NEW HORIZON AIRCRAFT (nASDAQ: HOVR)

👉HOVR is TODAY’S #1 ALERT 👈

Hey gang, Jeff Bishop here.

It looks like stocks may give up a bit of their recent winnings today, if stock futures are anything to go by.

Three of my “tactical trade” ideas this week have gone on to rip double-digits the day I alerted them. One even closed up 51%, and has powered UP over 65% now from when I first alerted you to it.

Today, I’m focused on a small stock that has had some great runups recently.

When I last alerted it back in September, it had a respectable 14% gain on the day.

Take a look at New Horizon Aircraft Ltd. (HOVR) on your favorite platform and you’ll see what I mean…

From its low on March 4, it went on to rally 50% in two weeks…

Then, from its April 14 low, it cruised up 51% in two weeks.

The stock has pulled back a bit from there, and I’m watching it closely to see if we get another “bottom bounce.”

Just moments ago, HOVR announced some very BIG NEWS that is starting to get around the markets right now.

From the release… Horizon Aircraft’s unique Cavorite X7 eVTOL becomes the first aircraft in the world to achieve a stable transition using a novel fan-in-wing design.

This is a major breakthrough in eVTOL (electric vertical take off and landing) flight, and could have serious implications for HOVR moving forward.

Today could be a BIG one for HOVR, so make sure it is on your radar immediately.

The more I look into this company, the more I like it.

HOVR is a Canada-based advanced aerospace engineering company that was founded in 2013 by a father-son team and is led by them to this day.

The father, Brian Robinson, has for more than 50 years owned, operated, and modified a variety of aircraft, and today serves as HOVR’s chief engineer.

The son, Brandon Robinson, is a CF-18 Fighter Pilot Top Gun grad with degrees in mechanical engineering and an MBA. He serves as the company CEO.

HOVR is developing one of the world’s first hybrid electric Vertical Takeoff and Landing (eVTOL) aircraft.

You can read all about eVTOL aircraft here, but the essential thing is they use electric power to hover, take off, and land vertically. They’re something like oversized drones.

HOVR’s eVTOL model is called the Cavorite X7, and though it is only in development now, the company projects it will have:

- A 250 mph top speed

- A range over 500 miles with fuel reserves

- Seating for six passengers and a pilot

- A 1,500 lb payload

It will be able to take off and land vertically just like a helicopter, but will be capable of speeds nearly twice as fast.

That would have obvious utility for medevac and military purposes, but also for Advanced Air Mobility, which involves using low-cost, energy efficient aircraft to transform regional air travel and cargo delivery.

HOVR believes the Cavorite X7 will be able to touchdown on a helipad or an area the size of a tennis court, so it’s easy to see how executives might even use it to commute to work.

All of this is possible thanks to the Cavorite X7’s patented vertical lift system, which uses 14 powerful lift fans to provide the thrust for vertical takeoff:

After reaching a safe height, a traditional propeller increases power for forward flight. Once the aircraft reaches 71 mph, the wings slide closed, resulting in flight just like a normal aircraft:

The process works in reverse for landing.

To date, the company has done real-world testing on a 50%-scale prototype, including a hover flight test, which you can check out in this video.

HOVR says its “conservative simulations indicate the Cavorite X7 could offer as much as 30% lower direct operating costs than a helicopter conducting a similar regional transport mission” and at almost twice the speed.

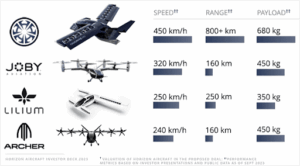

The company also estimates that its aircraft will have industry-leading speed, range, and payload:

Thus far, the company has attracted considerable attention in some very high places…

In January 2022, the innovation arm of the U.S. Air Force awarded HOVR nearly $400k USD “to demonstrate the viability of the Cavorite VTOL concept.”

That April, “the Horizon Aircraft team hosted the USAF and USSOCOM AFWERX teams at the primary assembly facility.”

In December 2023, the company secured a $6.7 million CAD investment from Canso Investment Counsel, which CEO Brandon Robinson called “an experienced investor in aviation and space technology.”

Most impressively, a leading regional air transportation company in India, JetSetGo, entered into a Letter of Intent in January 2024 with HOVR to purchase $250M USD of Cavorite X7 aircraft at $5 million each, with the option to purchase an additional 50 aircraft for a possible total of $500M.

JetSetGo’s CEO Kanika Tekriwal said, “Our decision to enter into this Agreement with Horizon Aircraft was not taken lightly. We ultimately decided to partner with a company with a deep operational and aerospace technology background that will deliver a product that will help usher in a new era of sustainable air travel while also providing significant value for our customers.”

In September 2024, HOVR said it was “in active design and manufacturing of a full-scale technical demonstrator aircraft.”

HOVR released huge news in December 2024 of an $8.4 million investment that would “fortify Horizon Aircraft’s balance sheet, provide stability in the operations, governance and regulatory priorities, and fund further development and flight testing of its hybrid eVTOL, the Cavorite X7.”

That news sent its stock soaring more than 150% over five trading days.

And this January, HOVR signed a letter of intent with a leading Chilean helicopter operator, Discovery Air Chile Ltda., to lease five Cavorite X7 eVTOLs with a projected delivery timeline of 2028.

HOVR has since fortified its design team, bringing in top propulsion expert John Wyzykowski in February and former Rolls-Royce propulsion expert Justin Chapman just last week.

Analyst firm D. Boral Capital set a 12-month price target of $2.00 on HOVR back in October, which is 330% upside from yesterday’s closing price.

Those are some notes to get your own research started. I recommend checking out the company’s YouTube channel and its slick website to discover more.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well, so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: HOVR is an ambitious company whose stock has pulled back a bit so far in May, but it has demonstrated fast, dramatic bounce-backs for the past several months.

HOVR could be ready for “liftoff” today – start watching it right away!

To Your Success,

Jeff Bishop

*Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from West Coast Media for advertising New Horizon Aircraft Ltd for a one day marketing program on May 15, 2025. Previously, we received twenty five thousand dollars (cash) from West Coast Media for advertising New Horizon Aircraft Ltd for a one day marketing program on September 12, 2024.

It might seem obvious, but while our client claims not to own any shares in Shuttle Pharmaceuticals Holdings, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither RagingBull nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Shuttle Pharmaceuticals Holdings might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Raging Bull nor its owners, employees, or independent contractors are registered as a secur1.ties br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry auth.ority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.