Sponsored by Primetime Profiles and Disseminated on Behalf of Health in Tech, Inc*

Monday Oct 6 , 2025

Health in Tech, Inc (Nasdaq: HIT)

👉HIT is TODAY’S #1 ALERT 👈

Hey Folks, Jeff Bishop here,

The government may be shut down, but the markets are chugging along very nicely.

There’s a lot of positive momentum out there, but as always, I’m looking for stocks that have a great chance of outperforming.

My “tactical trade” idea today is a small stock that has been doing that in spades — it’s up an incredible 402% over the last six months.

I first alerted this one back in July, and on the day of my alert, it jumped a staggering 66% intraday.

💥Go ahead and pull up Health In Tech Inc. (HIT) on your favorite trading platform.

You’ll see the stock has been in a classic uptrend since July: Each pullback has been followed by a higher low, and each rally has reached a higher high.

The stock has been trading sideways overall since mid-September, and with positive action in the pre-market, I’m watching to see if we get a breakout today.

👉 HIT is TODAY’S #1 ALERT 👈

Here’s why this one could be primed for a tear…

HIT describes itself as “an insurance exchange platform revolutionizing the self-funded health care market.”

Self-funded health plans allow companies to pay claims directly, with stop-loss protection for big bills.

HIT has a proprietary platform that “streamlines complex underwriting, enhances transparency, and empowers every participant in the healthcare ecosystem.”

As you know, healthcare in the U.S. is dominated by big players like UnitedHealth, but upstarts like HIT are leveraging AI to potentially disrupt their business.

The company is operating in 41 states with 942 business clients, 24,839 enrolled employees, and 778 brokers, Third-party Administrators (“TPAs”) and Additional Third-party Agencies.

Here’s how their AI-powered model works:

- Plan Design and Customization — Through its stop-loss arm Stone Mountain Risk, the company “works with brokers, third-party administrators (TPAs), and healthcare vendors to create customized health plans tailored to each small employer’s needs.”

- Underwriting and Risk Assessment — The company’s proprietary eDIYBS (e- Do It Yourself Benefits) platform turns weeks into minutes with “the only online, fully autonomous self-funded quoting platform available for brokers, [Managing General Underwriters], TPAs, and more.”

- Claims and Payment Management — HIT’s proprietary HI Card technology is “a single standardized transaction platform for providers, payers, and patients alike.”

- Provider Network Integration — The company’s HI Performance Network allows Medicare-based reimbursement pricing across 50 states, 8,800+ hospitals, and 1.4+ million provider locations.

I’m not an expert on health plans/insurance, so for me, the most important thing is the company’s balance sheet…

In 2024, total revenue hit $19.5 million with net income of $670,000 — a positive bottom line.

But it’s in 2025 that things have really taken off.

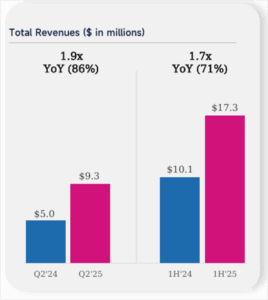

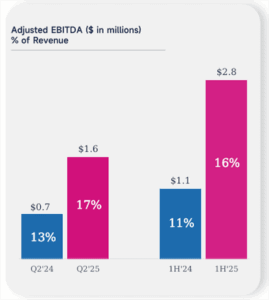

On July 21, HIT released its Q2 earnings. Total revenue reached $9.3 million — up 86% year over year — and net income was $338,000.

For the first half of 2025, the company saw revenues of $17.3 million — nearly equal to the entirety of 2024. Adjusted EBITDA was $2.8 million — 1.2x the figure for 2024.

All of this was thanks to a 5,738 increase in the number of billed employees compared to this time last year.

These are huge increases for a company that has been around since 2014.

In April, HIT’s CEO Tim Johnson appeared on The Street Report podcast — which you can listen to here — to discuss the company and its rapid revenue growth.

In June, Chief Growth Officer Dustin Plantholt was interviewed live from the NYSE on New to The Street, which airs on Bloomberg TV.

On September 22, the company revealed it had upgraded its eDIYBS system, which previously focused on small employers, so it could accommodate medium-to-large employers as well.

HIT CEO Tim Johnson said, “This isn’t about incremental improvements. We’ve fundamentally redesigned how healthcare insurance gets bought at scale.”

And on September 30 — last Tuesday — HIT said it had signed a non-binding strategic Letter of Intent with AlphaTON Capital “to jointly develop HITChain — a blockchain-enabled healthcare insurance claims processing platform built on The Open Network (TON).”

The press release explained, “HITChain is designed to address one of the largest pain points in U.S. healthcare: claims processing inefficiency, fraud, and opacity. By combining Health In Tech’s insurance expertise with AlphaTON’s blockchain infrastructure and security protocols, HITChain seeks to establish an immutable, transparent, and efficient claims ecosystem that reduces administrative costs, improves trust among stakeholders, and creates measurable value for employers, providers, brokers, and insurers.”

Be sure to do your own homework on HIT. You’ll for sure want to check out the company’s accessible investor presentation and its website.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: HIT is showing classic post-breakout consolidation behavior after a strong multi-month uptrend.

As long as it holds above $3, the setup remains bullish, with a potential second leg higher if it breaks through $3.70 on volume.

💥With positive action in the pre-market, keep HIT at the top of your radar today to see how it plays out!

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received five thousand dollars (cash) from Primetime Profiles for advertising Health in Tech, Inc for a one day marketing program starting on October 6, 2025, prior to this we received twenty five thousand dollars (cash) from Primetime Profiles for advertising Health in Tech, Inc for a one day marketing program starting on July 22, 2025. It might seem obvious, but while our client claims not to own any shares in Health in Tech, Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Health in Tech, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.