Consumers Are Scared, and That Means — Opportunity!

The headlines have been impossible to miss: In 2025, consumer confidence has cratered.

At his inauguration, President Trump promised we were entering a new “golden age of America,” but so far, consumers aren’t buying it.

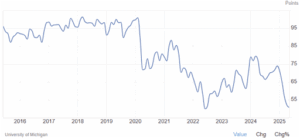

The University of Michigan’s Consumer Sentiment Index is the gold standard here, and you can see it has dropped more than 23 points so far this year:

Credit: Trading Economics

The reading this month was the second-lowest on record. The only worse reading was in June 2022, when inflation hit a 40-year high of 9.1% year-over-year.

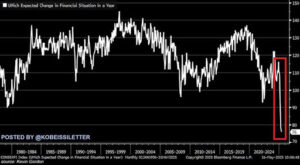

Meanwhile, consumers’ expectations of their financial situation over the next year dropped to an all-time low this month. As The Kobeissi Letter points out, that’s “lower than in 2008 and the late 1970s, when inflation was at 12-13%.”

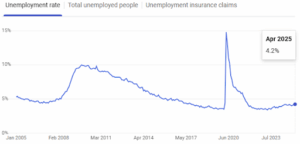

On paper, this shouldn’t be happening. The CPI hit 2.3% in April, its lowest reading since 2021, and unemployment reached 4.2% — still pretty low relative to pre-2018 and certainly low compared to the Covid years:

Poor consumer sentiment is a big deal for an economy whose GDP is about 70% dependent on personal consumption expenditures. If consumers tighten their belts, their pessimism may become self-fulfilling.

Now, let’s take a step back and think about what this means for you as a stock-market trader/investor. When consumers are this pessimistic, fear spreads fast…

Stocks tied to consumer spending — think retail, hospitality, or entertainment — may take a hit. The crowd will likely rush to sell off those stocks, chasing the latest “safe” investment trends (gold and Bitcoin are looking like the go-to’s right now).

But here’s the thing: following the herd rarely makes people rich. In fact, it often leads to people buying high and selling low — the exact opposite of what you want.

This is a chance to take control of your finances. It’s important to understand other people’s fear while not letting your own fear dictate your moves.

Instead, use this moment of uncertainty to your advantage. While everyone else is running scared, you can be tactical…

Look for undervalued, underfollowed stocks that the crowd hasn’t discovered yet. These are the hidden gems — companies with solid fundamentals that are trading at a discount because most traders are too busy panicking to notice them.

Think about industries that might be overlooked right now. Maybe it’s a small mining company that just got all its permits in order. Or a clinical-stage biotech with some promising catalysts on deck. The key is to act before the crowd catches on.

Taking control of your finances means trusting your own homework, not the market’s mood. The consumer sentiment data is definitely a red flag, and we’ll almost certainly face more “trade war” uncertainty ahead — President Trump gave us a nice reminder of that over the past few days…

By focusing on undervalued stocks right now, you can find opportunities with the potential to surge regardless of what the broader indexes are doing.

(I alerted subscribers to my exclusive SMS list of one such opportunity on Friday that closed the day up 21% despite the major indexes closing in the red.)

So don’t chase the herd; don’t let fear drive your decisions. Dig into those underfollowed stocks, do your homework, and stick to your trading plan.

Take control today and you’ll thank yourself tomorrow.

To Your Success,

Jeff Bishop

P.S. You can text the word “RAGE” to 1-(888) 487-1534 to join my SMS list at no cost right now.

*Disclosure: By texting “RAGE” to 1-(888) 487-1534, you agree to receive promotional messages sent via an autodialer. You also agree to the terms of service and privacy policy. This agreement isn’t a condition of any purchase. Message frequency varies. Message and data rates may apply. Reply STOP to opt out; HELP for more information.