Issuer-Sponsored Content on Behalf of Nuburu, Inc*

thursday Feb 12 , 2026

Nuburu, Inc (NYSE: BURU)

👉URGENT ALERT:BURU Breakout👈

Good morning, Folks,

The snow and ice are finally melting here in Virginia, and my “tactical trade” ideas are heating up as well…

On Tuesday, we saw two ideas surge double-digits intraday, and yesterday’s idea was picture-perfect by the close:

At hand today is a stock I alerted last May before it made a 14% intraday gain.

From the time of that alert — and in less than a month’s time — the stock roared more than 220%.

💥Have a look at Nuburu, Inc. (BURU) on your trading platform.

As you can see, the stock has had some big swings since then. The company is pursuing several acquisitions, so there is a lot going on.

This is a situation you should look into very carefully and monitor for breaking news, as the stock’s price is tracking news updates very closely.

Here’s what’s at play…

Nuburu, Inc. (BURU) is a Colorado-based company founded in 2015 as a developer and manufacturer of industrial blue-laser technology.

BURU is swinging for the fences with a bold Transformation Plan that could make it as a company.

On May 12, the company announced a pivotal step:

On May 20, BURU added some color: the targeted acquisition “currently accounts a portfolio of approximately 60 clients across seven countries (including the USA, Italy, and UAE) and accounts a robust backlog of orders totaling $309 million, and options for an additional $181 million.” [emphasis added]

Two days later, it revealed that the target is TEKNE, “a distinguished provider of integrated electronic warfare and cyber capabilities within military vehicles.”

The company has annual revenue of $50 million and is “a pioneer in jammer technology.” It has a strategic partnership with US Flyer Defense to produce a tactical vehicle that will “enhance the capabilities of the Italian Armed Forces and other NATO allies.”

But because TEKNE is an Italian company with defense applications, the acquisition requires approval from the Italian government under the “Golden Power” regulations, “which oversee foreign investments in critical sectors aligned with national security interests.”

On August 7, BURU released its plan for a phased acquisition of TEKNE, “beginning with a minority investment and followed by a staged regulatory path toward full control, under the Golden Power procedure.”

Here are the basics:

- Phase 1: “NUBURU will immediately acquire a minority, non-controlling stake in TEKNE through a capital infusion”

- Phase 2: “In Q4 2025, NUBURU and TEKNE will establish a U.S.-based joint venture (80% NUBURU / 20% TEKNE) to deploy blue-laser-based defense solutions”

- Phase 3: “NUBURU plans to complete the controlling acquisition of TEKNE in Q4 2025, pending further regulatory clearance”

On August 21, the company announced execution of Phase 1. It acquired an initial equity stake in TEKNE equal to the maximum allowed (3%) under the Golden Power regulatory thresholds, and it “agreed to an action plan that … will pave the way to a controlling interest in Tekne.”

BURU also revealed an “upcoming acquisition of an operational resilience SaaS platform, a move designed to add software capabilities to its defense offering.” [emphasis added]

On September 9, the company said that the 80/20 joint venture with Nuburu and Tekne was formed.

On October 7, BURU revealed it secured a binding agreement to acquire the SaaS company, Orbit S.r.l., “an Italian software company specializing in operational resilience, business continuity, and crisis management for mission-critical organizations.”

That sent the stock soaring, as you can see if you check out BURU’s chart.

Later that month, the company entered a Strategic Framework Agreement to establish a joint-venture company with Maddox Defense Incorporated.

“Controlled by Nuburu Defense, the JV Company will focus on the compliant development, manufacturing, and deployment of advanced drone systems for both military and commercial applications.” [emphasis added]

And on December 1, BURU announced signing of a Binding Agreement to acquire Lyocon S.r.l., “an Italian laser-engineering and photonics company specializing in advanced laser sources, precision optical systems, and customized laser platforms for industrial, medical, and high-reliability applications.”

The company said this strengthens its “transformation into a vertically integrated Defense & Security Technology Hub spanning lasers, RF systems, mobility platforms, and software-enabled defense architectures.”

You can read a good summary of all these acquisitions in this February 5 press release.

On Tuesday, the company filed a preliminary prospectus with the SEC for a public offering of up to 115,000,000 shares of common stock along with common warrants to purchase up to an aggregate of 172,500,000 shares.

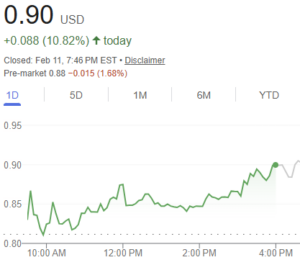

That initially sent the stock tumbling, but if you zoom in on the stock’s chart, you’ll see that the stock not only found a bottom that afternoon, it’s actually up 19% from its low that day.

The stock actually surged double-digits after hours last night, and I’m watching it closely today to see if it keeps up the momentum from here.

👉 BURU is TODAY’S #1 ALERT* 👈

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of our compensation and other conflicts of interest, as well as additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: BURU is transforming into a vertically integrated defense and security platform and has a lot of irons in the fire.

Its stock is up 19% from its low two days ago, and with a double-digit move after hours, I’m locked in today to see where the momentum takes it.

To Your Success,

Jeff Bishop

*ISSUER-PAID DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifty thousand dollars (cash) from Nuburu, Inc (via Bullzeye Media) for a two day marketing program starting on February 12, 2026. Previously, we received twenty five thousand dollars (cash) from Beyond Media for advertising Nuburu, Inc for a one day marketing program starting on September 17, 2025. Previously, we received twenty five thousand dollars (cash) from Beyond Media for advertising Nuburu, Inc for a one day marketing program starting on August 25, 2025, and we also received fifteen thousand dollars (cash) from Sica Media for advertising Nuburu, Inc for a one day marketing program on May 12, 2025. To date, we have received a total of one hundred fifteen thousand dollars for advertising Nuburu, Inc.

It might seem obvious, but while our client claims not to own any shares in Nuburu, Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Nuburu, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.