Sponsored by Virtus Media Group and Disseminated on Behalf of Autonomix Medical*

TUESDAY sEP 2 , 2025

Autonomic Medical (Nasdaq: AMIX)

👉AMIX is TODAY’S #1 ALERT 👈

Hey Folks, Jeff Bishop here,

I hope you had an awesome Labor Day weekend.

I got a chance to recharge 🔋, and now I’m fired up and back in action.

There’s a fascinating little company on my radar right now that’s worth looking into right away.

The company is a medical device company called Autonomix Medical Inc. (AMIX), and it’s backed by some serious heavyweights.

Its executive chairman is Wally Kemp, who sold the last medical device company he founded for $550 million in cash in 2021:

AMIX’s co-founder and chief medical officer is Dr. Robert Schwartz, who invented the Watchman stroke prevention device. That device, acquired by Boston Scientific, generated $1 billion in revenue for the company in 2022.

If you take a look at the chart for AMIX you’ll see the stock has drawn down quite a bit this year.

In late July, the company raised ~$2.5 million by exercising existing warrants. It also issued new warrants at an exercise price of $1.723 per share.

That has especially weighed on the stock price, but beginning last week, the stock inflected back up.

It’s up 11% since last Monday and was up again in the pre-market this morning.

As I’ll explain, this is a fascinating company pioneering a breakthrough medical device. With momentum at its stock’s back, I’m watching AMIX today to see if it kicks off the week strong.

👉 AMIX is TODAY’S #1 ALERT 👈

Based in my home state of Texas and founded in 2014, AMIX is a development-stage medical device company focused on advancing technologies for diagnosing and treating disorders involving the nervous system.

Here are 5 things that stood out in my research:

1. It’s Building the GPS for Your Nerves 🧭

AMIX says it is developing “the world’s first GPS for the nervous system” — a catheter-based microchip sensing array that lets surgeons sense, treat, and verify nerve ablation in real time.

Nerve ablation is basically when doctors shut down a nerve’s ability to send pain signals. It’s an effective technique. The problem is current tech forces doctors to operate more or less blind. AMIX is working to change that.

2. IP Fortress: Hundreds of Patents Worldwide 🏰

AMIX has built a fortress of intellectual property with 120+ patents issued or pending globally across 18 patent families.

Most recently, on August 20, the company received a patent from the European Patent Office titled “Medical Device with Circuitry for Capturing and Processing Physiological Signals.”

3. Clinical Milestones: Fast Pain Relief & Trial Expansions 🚀

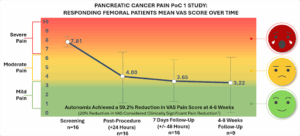

The company’s first-in-human proof‑of‑concept (PoC 1) trial in pancreatic cancer pain delivered statistically significant pain relief as early as 24 hours post‑procedure, with sustained improvement up to 4–6 weeks, and no device or procedure-related serious adverse events.

Some highlights:

- The trial had 20 subjects

- “100% of patients (n=16) with femoral access responded to treatment”

- “Responding patients had a mean 4.67 pain reduction or 59.2% improvement at 4-6 weeks”

- “100% of Responders Required Zero Opioid Use at 7 Days” and “73% of responding patients were at zero opioid use at 4-6 weeks” (so even with disease progression)

With that success at its back, the company has begun a follow-on phase to its proof-of-concept human clinical trial (“PoC 2”). This phase is targeting “a broader range of high-need visceral cancer indications.”

4. U.S. Clinical Trials: Major Regulatory Step Forward 🏁

On August 14, AMIX announced it had finalized the design review for its intravascular nerve‑sensing catheter — a critical hurdle on the path to filing its Investigational Device Exemption (IDE).

That’s a crucial step toward human trials in the U.S. and (hopeful!) De Novo FDA approval.

5. Analyst Thinks It’s a Buy 🚀

Anthony Vendetti of the Maxim Group reiterated a “Buy” rating on AMIX on August 29 with a price target of $5. That’s 346% upside from Friday’s closing price.

As you do your own research on AMIX, be sure to review this August 2025 investor presentation, which is delightfully clear even to a layperson like me.

The company’s website is definitely worth checking out as well. I especially appreciated the videos on its homepage, which give a great idea of how its “GPS for the nervous system” works.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: AMIX is pioneering a medical device that could disrupt the standard of care for a host of conditions. Its stock is up 11% since last Monday, and I’m watching it for more momentum.

💥Tune into AMIX today to see if this one keeps rocking!

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from Virtus Media Group for advertising Autonomix Medical, Inc for a one day marketing program starting on September 2, 2025. It might seem obvious, but while our client claims not to own any shares in Autonomix Medical, Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Autonomix Medical, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.