Sponsored by Interactive Offers and Disseminated on Behalf of Foremost Clean Energy*

Wednesday Oct 29 , 2025

Foremost Clean Energy

(Nasdaq: FMST)

👉FMST is TODAY’S #1 ALERT 👈

Good morning, Folks,

Earnings are coming in strong this week, and with Alphabet, Meta, and Microsoft set to report this evening — alongside the Fed’s rate-cut decision this afternoon — we should see some real fireworks.

This week, I’ve been especially focused on URANIUM stocks.

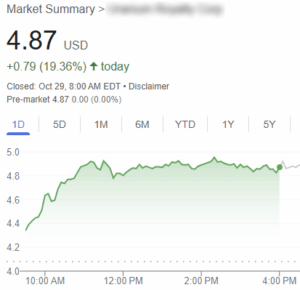

My top “tactical trade” idea yesterday was one such company, and here’s how it looked by the closing bell:

Not too shabby!

That stock is now up about 170% over the past six months, but it pales in comparison to today’s “tactical” idea…

💥Feast your eyes on the beautiful chart of Foremost Clean Energy Ltd. (FMST).

It’s a uranium and lithium exploration company whose stock is up about 370% over the last six months.

I managed to alert it several times over that period. One of my alerts was on the morning of May 12. Here’s how it looked by the end of the day:

By the end of that week, it had increased by 164% from my initial alert.

A few weeks later, FMST had run 400% from that initial alert.

It was one of the best “tactical” runs we have seen in a long time.

I alerted it again on June 4, and by the following day, it had climbed 31% from my alert.

You’ll see the stock pulled back from there through late July, but it’s enjoyed a very steady and solid runup since then.

Over the last month alone, it’s up about 18%.

Well, just yesterday, we learned that the Commerce Department signed an $80 billion nuclear deal with Westinghouse (🤯).

Westinghouse is 49%-owned by Cameco, a uranium giant built on discoveries in the Athabasca Basin — the same ground FMST is actively exploring and drilling.

Every day, it seems, new headlines point to soaring demand for uranium, but this is an especially huge one.

💥Tune into this “tactical trade” Hall of Famer 🏆 today to see where the news powers it.

👉 FMST is TODAY’S #1 ALERT 👈

So why are uranium stocks like FMST soaring?

A glaring vulnerability is now on a collision course with the AI boom…

Data center energy demand is reaching unprecedented levels, and NVIDIA CEO Jensen Huang has stated, “Winning the AI race is impossible without nuclear power.”

Why? Because ONE AI data center can eat the output of an entire nuclear reactor.

Energy Secretary Chris Wright announced last month that “We are moving to end the use of Russian enriched uranium. We expect rapid growth in U.S. uranium consumption and urgently need to expand domestic uranium and enrichment capacity.”

That’s why nuclear energy is suddenly sexy again, and URANIUM is the bottleneck… because AI requires immense amounts of power.

And the federal government is clearly placing its bets on nuclear. On May 23, President Trump signed an executive order that generated this headline:

The President “outlined plans to overhaul the U.S. nuclear regulator, fast-track licenses for new projects, boost domestic fuel supplies and use federal lands for reactors for the military or large data centers for artificial intelligence.” [emphasis added]

The White House said his executive orders would “usher in a nuclear renaissance.”

And on June 3, the Wall Street Journal reported that “Meta Signs Nuclear Power Deal to Fuel Its AI Ambitions.”

In July, Westinghouse revealed plans to build 10 large nuclear reactors in the U.S., with construction to begin by 2030.

Each of the reactors will generate enough electricity to power 750,000 homes.

Wall Street’s All In: Mercuria, a $15B commodities giant, just launched a physical uranium trading desk, hiring away a top Goldman Sachs uranium trader.

Citi and Natixis are building out uranium desks too. They see what’s coming: Uranium demand is set to double by 2040. When the biggest traders on the planet enter the market, you pay attention.

These bold ambitions will clearly require a reliable supply of uranium, and FMST is in a unique position to capitalize…

Its exploration efforts provide a critical North American uranium solution at a pivotal time, leveraging the fact that Canada already supplies 25% of U.S. uranium and new federal policies are igniting a supply race.

On June 20 of this year, Sprott Physical Uranium Trust (SPUT) announced a $200M deal to acquire physical uranium.

The predictable result of all of this is that the uranium price is up 22% since its March low, reversing a months-long decline. On a longer timeframe, if you compare it to November 2020, uranium is up 165%.

With all these market dynamics in place, high-grade explorers like FMST find themselves very well positioned.

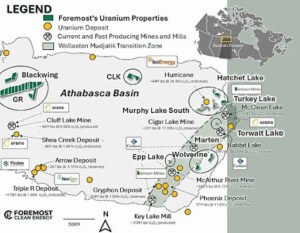

The company itself holds a diversified portfolio of 10 properties in Canada’s Athabasca Basin, the world’s richest uranium region, with grades 10 to 100 times higher than the global average.

One competitive advantage FMST has is its partnership with uranium producer Denison Mines Corp (NYSE American: DNN & TSX: DML), which gave FMST the option to acquire up to a 70% interest in 10 uranium exploration properties.

This is a total game changer. Denison — “a clear leader in the uranium sector” — purchased an additional 485,000 shares in FMST just last month, bringing its total ownership to about 19.17% of FMST’s outstanding common shares.

Denison also provides FMST technical/financial backing — de-risking exploration while offering direct access to their uranium expertise and vast industry network. It’s clearly vested in its partner’s success.

The 10 properties span over 330,000 acres located in the Athabasca Basin in Saskatchewan, an area “with robust infrastructure and known to host some of the world’s richest uranium deposits producing ~15% of world’s primary uranium supply, where grades routinely hit 10-100X global average!” It’s often called the “Saudi Arabia of Uranium”!

Foremost’s properties, surrounded by uranium mines and mills

As a bonus, FMST maintains a portfolio of lithium and gold projects at varying stages of development with extensive past drilling, located across 55,000+ acres in Manitoba and Quebec — giving investors battery metals exposure without dilution.

In March, FMST announced a $6.5 million fully-funded exploration program on its diverse portfolio within proven uranium corridors surrounding or near some of the world’s largest and highest-grade uranium operations, including the McArthur River and Cigar Lake mines.

FMST confirmed multiple drill programs will turn in 2025 on drill-ready and permitted targets, positioned along strike of recent high-grade discoveries providing investors de-risked exploration within a tier 1 district.

Denison, thanks to its years of previous exploration, including drilling and geophysical surveys, is providing FMST a validated roadmap, enabling high- potential targeted drilling on mineralized zones and providing FMST a clear competitive advantage from the outset.

Murphy Lake South: The property runs alongside the LaRocque corridor — home to IsoEnergy’s Hurricane Deposit (48.6M lbs @ 34.5% U3O8). This is the geological zone where monster discoveries happen.

The company’s 8-hole, 2,500 meter diamond drill program at the property commenced in September.

In August, the company announced the results of its recently completed radon survey at the Wolverine Uranium Property. CEO Jason Barnard said they “provide strong evidence that the interpreted structures at Wolverine are associated with elevated radon anomalies which may suggest the presence of subsurface uranium.”

The company plans to use the results “to refine high-priority drill targets for future testing.”

Interestingly, in September the company announced that a 2,500 meter drill program at its Jean Lake Gold-Lithium Property would commence that month.

The program “is strategically designed to capitalize on record-high gold prices by expanding known high-grade gold and lithium mineralization identified in the 2022-2023 drill campaign.”

The company will be following up on high-grade intersections including 3.28 ounces per ton gold.

Just this month, FMST revealed it received a three-year exploration permit from the Saskatchewan Ministry of Environment for its Hatchet Lake Uranium Project.”

The company said a phase 2, 3,000-meter drill program “is being planned for winter 2025–2026.”

FMST maintains a lean capital structure. With about 12.2 million shares outstanding and with an ultra-tight float of less than 10 million shares, FMST‘s structure is a volatility amplifier.

As you do your own research on FMST, be sure to take a look at this investor presentation released this month as well as the company website.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: FMST has been on rocket ride over the last six months — shooting up 370%.

With the fed gov announcing an $80 billion influx into nuclear, I’m watching FMST today to see how the stock responds.

💥Stay locked into FMST to see where it goes!

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand five dollars (cash) from Interactive Offers for advertising Foremost Clean Energy Ltd for a one day marketing program starting on October 29, 2025. Prior to this, we received thirty five thousand five dollars (cash) from Legends Media for advertising Foremost Clean Energy Ltd for a two day marketing program starting on September 2, 2025. Before this, we received five thousand five dollars (cash) from Primetime Media for advertising Foremost Clean Energy Ltd for a one day marketing program starting on August 20, 2025. Additionally, we received fifteen thousand five dollars (cash) from Sica Media for advertising Foremost Clean Energy Ltd for a one day marketing program starting on August 7, 2025. We also received thirteen thousand five hundred dollars (cash) from Sica Media for advertising Foremost Clean Energy Ltd for a one day marketing program starting on July 16, 2025. Additionally, we received twenty-five thousand dollars (cash) from Sica Media for advertising Foremost Clean Energy Ltd for a one day marketing program starting on July 2, 2025. Prior to this, we received thirty-five thousand dollars (cash) from Sica Media for advertising Foremost Clean Energy Ltd for a two day marketing program starting on June 4, 2025. Before this, we received $3750 (cash) from Shore Thing Media for advertising Foremost Clean Energy Ltd for a one day marketing program starting on May 20, 2025, and we also received thirty five thousand dollars (cash) from Sica Media for advertising Foremost Clean Energy Ltd for a two day marketing program starting on May 12, 2025, and also thirty five thousand dollars (cash) from Legends Media for advertising Foremost Clean Energy Ltd for a one day marketing program on March 4, 2025, and also we received fifteen thousand dollars (cash) from BullzEye Media for advertising Foremost Clean Energy Ltd for a one day marketing program on February 24, 2024. To date, wehave received a total of two hundred thirty two thousand two hundred and fifty dollars for advertising Foremost Clean Energy Ltd

It might seem obvious, but while our client claims not to own any shares in Foremost Clean Energy Ltd, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Foremost Clean Energy Ltd might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.