Sponsored by Virtus Media Group and Disseminated on Behalf of OS Therapies*

wednesday Oct 22 , 2025

OS Therapies (NYSE: OSTX)

👉OSTX is TODAY’S #1 ALERT 👈

- Sponsored by Virtus Media Group and Disseminated on Behalf of OS Therapies*

- wednesday Oct 22 , 2025

- OS Therapies (NYSE: OSTX)

- Hey Folks, Jeff Bishop here with a hot stock idea for you.

- Right now, the stock is testing support around $1.75–$1.80, which lines up with its previous breakout level in late June.

- 1) Big unmet need + first-in class in a rare cancer 🦴

- 2) It hit statistically significant data, and regulators are paying attention 📊

- 3) Bonus regulatory “niceies” + commercial optionality 🚀

- 4) Pipeline + multiple shots on goal 🎯

- 5) Smart commercial planning + timing on their side ⏳

Hey Folks, Jeff Bishop here with a hot stock idea for you.

This is a clinical-stage biotech that’s starting to look very interesting.

💥Go ahead and pull up the chart of OS Therapies Incorporated (OSTX).

Right now, the stock is testing support around $1.75–$1.80, which lines up with its previous breakout level in late June.

That was a consolidation zone that acted as the base before the August run to $2.50+.

If the bulls start buying up shares here, that sets the stage for another potential bounce.

The volume has really been drying up during this latest pullback, and that tells me this could be a “quiet retest” rather than panic selling.

That’s just what you want to see after a fast run-up.

The company is expecting a BLA submission this year, has ongoing FDA interactions, and even has a possible commercialization deal pending. Any of those things could be the catalyst for the next rally.

Tune into OSTX as the day goes on to see if support holds and we get a bounce from here.

👉 OSTX is TODAY’S #1 ALERT 👈

Here are the top 5 things to know about the company…

1) Big unmet need + first-in class in a rare cancer 🦴

OSTX is targeting osteosarcoma, a rare but brutal bone cancer that’s had virtually no new treatments in decades.

Its lead asset, OST‑HER2, is an immunotherapy approach aimed specifically at HER2-positive cancers such as osteosarcoma.

The company says it “activates the body’s immune system to fight cancer more effectively by training T cells to seek out and destroy cancer cells.”

Because of the rarity of the cancer and its high unmet need, regulatory agencies are more open to accelerated pathways (we’ll hit that later). That gives a small company like OSTX more “leverage” than if they were playing in a crowded, big-cancer space.

2) It hit statistically significant data, and regulators are paying attention 📊

OSTX is moving beyond the “we hope” stage — it has demonstrated positive data.

For example: In its Phase 2b trial of OST-HER2 in recurrent, fully-resected pulmonary metastatic osteosarcoma, it achieved a statistically significant benefit in 12-month event-free survival (EFS) — the primary endpoint of the study.

The company had a successful End-of-Phase 2 Meeting with the FDA earlier this year, and just last Friday, it announced the FDA granted a second Type C Meeting ”to gain alignment on the clinical efficacy data endpoints to support a Biologics Licensing Application (“BLA”) under the Accelerated Approval Program.”

The meeting is scheduled for December 11.

3) Bonus regulatory “niceies” + commercial optionality 🚀

The company is stacking up regulatory perks: OST-HER2 has received Rare Pediatric Disease Designation (RPDD), Orphan Drug Designation (ODD), and Fast Track Designation (FTD) from the FDA, and it’s requesting RMAT (Regenerative Medicine Advanced Therapy) status.

These designations can — if everything clicks — lead to faster approvals, less competition, premium pricing, and potential Priority Review Voucher (PRV) sale.

For example: if OST-HER2 is approved for that rare pediatric indication, OS Therapies becomes eligible for a PRV which it plans to sell to fund further work.

That gives it a sort of “built-in optionality hedge” — not the usual “make the drug and sell it,” but “make the drug, get the voucher, sell it, fund next moves.”

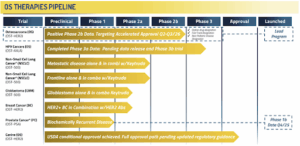

4) Pipeline + multiple shots on goal 🎯

OSTX isn’t just a one-trick pony. While OST-HER2 is the lead, OS Therapies also has a pipeline of next-gen platforms: e.g., a “tunable antibody drug conjugate” (tADC) platform, and other immunotherapy/ADC combos.

Plus, in January, the company acquired IP/assets for Listeria-based immuno-oncology programs (from Ayala Pharmaceuticals) that include phase-2 lung cancer and phase-1 prostate cancer programs. BioSpace

So if OST-HER2 pans out, the company has room to scale into other HER2-positive tumours or completely different solid tumours — which means the upside is greater than just the rare cancer niche.

5) Smart commercial planning + timing on their side ⏳

Here’s what really excites me: OSTX has already inked a U.S. commercialization partnership with EVERSANA Inc. for OST-HER2 in the U.S. (for pediatric osteosarcoma) — meaning it’s prepping for launch.

In March, OSTX formed a subsidiary for the canine osteosarcoma opportunity (yes, dog cancers count) via “OS Animal Health” — which can generate early revenue and prove the platform.

It notes that OST-HER2 “has been conditionally approved by the U.S. Department of Agriculture for the treatment of canines with osteosarcoma.”

And the cash runway looks extended: In July, OSTX closed a warrant exercise inducement/exchange offer, raising ~$4.2M. That pushes its cash runway beyond September 30, 2026 (that’s a key regulatory milestone).

That means less immediate dilution risk.Final Thoughts

The stars are aligning for OSTX.

With positive clinical data and regulatory meetings, commercial launch prep underway, and the potential for an optional PRV sale, OSTX is setting up about as good as you can hope for in small-cap biotech.

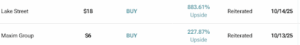

It’s no surprise, then, that analysts set buy targets with multibagger potential just this month:

Be sure to do your own research, of course, starting with this solid 2-page company summary released just this month, as well as the company website.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from Virtus Media Group for advertising OS Therapies Inc for a one day marketing program starting on October 22, 2025.

It might seem obvious, but while our client claims not to own any shares in OS Therapies Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into OS Therapies Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.

Get Pro Nate Bear’s Featured Ticker of the MONTH (plus BONUSES) and LIVE-TRADE it every week – includes 365 day $MoneyBackG’tee (*sponsored by MTA)