Sponsored by Sica Media and Disseminated on Behalf of CERo Therapeutics Holdings*

Tuesday Oct 21 , 2025

CERo Therapeutics (Nasdaq: CERO)

👉CERO is TODAY’S #1 ALERT 👈

Hey Folks, Jeff Bishop here,

I kicked off the week with flair yesterday with three “tactical trade” ideas that all gained on the day.

One of them climbed 5% intraday. The second idea hit 18%. And the best performer looked like this by the closing bell:

This stock also did very well for us back in April.

On the day I alerted it, it saw a 77% intraday gain and at one point, it was the top mover for the entire market:

💥Have a look at the chart for CERo Therapeutics Holdings, Inc. (CERO).

As you can see, the stock had pulled back significantly over the past month, including a 16% drop on Friday.

I was watching it for a bottom-bounce yesterday, and that’s clearly what we got…

The momentum was strong throughout the day, but it still has plenty of upside even to hit its levels from last week.

That’s why I’m locked into it again today, to see where this bounce carries it.

👉 CERO is TODAY’S #1 ALERT 👈

CERO is a clinical-stage biopharma company that “focuses on genetically engineering immune cells to fight cancer.”

Headquartered in San Francisco, its mission is to “discover, translate, and deliver pioneering curative cell therapies that incorporate multiple forms of tumor clearance into single T cells.”

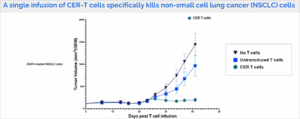

Its core technology is the CER T-cell platform, which targets both hematologic and solid-tumor cancers.

You can read more about the platform here, but in brief, it is based on a new class of engineered cells called chimeric engulfment receptors (CERs).

These are introduced into T cells, allowing “tumor recognition via an ‘Eat Me’ signal present on tumor cells” and stimulating both the innate and adaptive immune systems.

In preclinical testing, the platform demonstrated “tumor-killing capabilities for blood system and solid tumor cancers – Leukemia (AML), lung cancer (NSCLC), Ovarian Cancer, and B-cell Malignancies.”

The company believes “the differentiated activity of CER-T cells will afford them greater therapeutic application than currently approved chimeric antigen receptor (“CAR-T”) cell therapy.”

In November 2024, the FDA cleared CERO’s IND application “for Phase 1 clinical trials of its lead compound, CER-1236, in acute myelogenous leukemia (AML).”

And on March 31, it received an additional IND clearance for CER-1236 “for a Phase 1 clinical trial in advanced solid tumors, specifically non-small cell lung cancer and ovarian cancer.”

The company is first pursuing the Phase 1 trial for AML, revealing on April 9 that the trial will be led by an assistant professor of leukemia at The University of Texas MD Anderson Cancer Center, which CEO Chris Ehrlich calls “one of the most renowned cancer centers in the United States.”

CERO dosed its first patient in May for its Phase 1 clinical trial of CER-1236 in a study focused on patients with acute myeloid leukemia (AML).

In June, the FDA granted CER-1236 an Orphan Drug Designation (ODD) for the treatment of AML, which CEO Chris Ehrlich said “underscores the importance of developing new treatments for AML, and the potential for CER-1236 to provide a new and differentiated approach toward treatment.”

And in September, CERO revealed that CER-1236 had additionally received the FDA’s Fast Track Designation for AML.

Mr. Ehrlich said the FDA designations “are important additional validation with regard to the urgency of the condition as well as the potential that the agency sees in the existing data as submitted.”

Last Monday, CERO announced that it concluded the first cohort of its Phase 1 trial with the “observation of cell expansion consistent with preclinical expectations, with no dose-limiting toxicities observed.”

CERO Chief Medical Officer Robert Sikorski, M.D. said the “data collected to date support moving to the next planned dose level in accordance with the trial protocol.”

Most of this science is beyond my expertise, but it’s encouraging to see CERO has attracted investments from institutional heavyweights such as Sequoia Capital, Arch Venture Partners, and Altitude Life Science Ventures.

And on June 23, the investment bank D. Boral Capital reiterated a “BUY” rating on CERO with an $30.00 price target. Folks, that’s more than 1,200% upside over Friday’s closing price.

As always, be sure to do your own homework, starting with this September 2025 investor presentation and the company’s slick website.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: CERO is pioneering a therapy that in preclinical testing demonstrated tumor-killing capabilities for blood system and solid tumor cancers.

Its stock dropped sharply over the past month but began bouncing back in the pre-market this morning and was up double-digits ad the opening bell today.

💥Keep CERO at the top of your radar today to see where it goes!

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from Sica Media for advertising CERo Therapeutics Holdings, Inc for a one day marketing program starting on October 21, 2025. Additionally, we received five thousand dollars (cash) from Primetime Profiles Media for advertising CERo Therapeutics Holdings, Inc for a one day marketing program starting on October 20, 2025. Prior to this, we received twenty thousand dollars (cash) from Shore Thing Media for advertising CERo Therapeutics Holdings, Inc for a one day marketing program on April 24, 2025. To date we have received forty thousand dollars for advertising CERo Therapeutics Holdings, Inc.

It might seem obvious, but while our client claims not to own any shares in CERo Therapeutics Holdings, Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into CERo Therapeutics Holdings, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.

Get Pro Nate Bear’s Featured Ticker of the MONTH (plus BONUSES) and LIVE-TRADE it every week – includes 365 day $MoneyBackG’tee (*sponsored by MTA)