Sponsored by Sica Media and Disseminated on Behalf of Immix Biopharma, Inc*

Monday Oct 13 , 2025

Immix Biopharma (Nasdaq: IMMX)

👉IMMX is TODAY’S #1 ALERT 👈

URGENT ALERT: IMMX Breakout

Hey Folks,

Unless you just came out of a coma, you know the markets took a big hit on Friday after President Trump threatened a “massive increase of tariffs” on China. The S&P 500 and Nasdaq each wiped out about a month’s worth of gains.

But yesterday, the President posted some magic words to Truth Social: “Don’t worry about China, it will all be fine!”

Stock futures predictably jumped, and it’s looking like we’re in for a green day today.

Right now, I have my eye on a promising stock that could be in for an outsized rebound.

Do yourself a favor and check out the chart for Immix BioPharma (IMMX).

The stock has climbed more than 70% over the past six months, outpacing the S&P 500 more than threefold.

At the same time, the stock has tested significantly higher highs back in July, so there’s plenty of room to the upside.

The stock formed a clear base since August around the $2.00 level, but beginning October 3, it made a clean breakout and rose to above $2.50.

If it can hold above $2.40, the next technical target is around $2.90–$3.10.

With it reaching as high as $2.70 before President Trump’s bomb-drop on Friday, I’m watching it for a bounce-back today.

Make sure you are paying close attention to IMMX!

👉 IMMX is TODAY’S #1 ALERT 👈

Let’s see what the company is up to.

Los Angeles-based IMMX is pioneering cell therapies for immune-mediated diseases, most notably a rare disease called AL amyloidosis (ALA).

ALA is an often life-threatening disease caused by an abnormal protein called amyloid that’s produced by plasma cells in the bone marrow, and that accumulates in various organs, such as the heart, kidneys, liver, spleen, nerves, and digestive tract.

Symptoms vary according to where the deposits occur, but the most common ones are fatigue, swelling (especially in the legs), weight loss, shortness of breath, numbness or tingling in the hands and feet, and changes in bowel habits.

Although ALA isn’t a cancer, it is closely related to a type of blood cancer called multiple myeloma. ALA treatments include chemotherapy and in some cases stem cell transplants.

The prevalence of ALA was expected to hit 33,000 patients in the U.S. in 2024, and right now there is no FDA-approved treatment for relapsed/refractory cases.

That’s where IMMX sees a “blue ocean opportunity” for its NXC-201 CAR-T therapy, which the company describes as a “type of immunotherapy that uses the patient’s own immune cells, modified with ImmixBio proprietary technology, to create NXC-201, which is then introduced into the patient’s body.”

Those cells are then able to “recognize and eliminate diseased cells, with up to a 92% rate of disease reduction (overall response rate) in the case of relapsed/refractory AL Amyloidosis.”

Preclinical testing showed the treatment “completely eliminating AL Amyloidosis aberrant plasma cells from patient bone marrow.”

The main problems with traditional CAR-T therapies are cytokine release syndrome (CRS) and neurotoxicity.

Importantly, IMMX thinks its NXC-201 may have solved those problems, with a median CRS duration of just 1 day (4–8x shorter than other CAR-Ts) and zero neurotoxicity detected so far in AL amyloid patients.

The company says that “NXC-201’s uniquely favorable tolerability profile (no neurotoxicity + ‘Single-day CRS’) combined with proven preclinical and clinical efficacy make NXC-201 uniquely suited to treat AL Amyloidosis.”

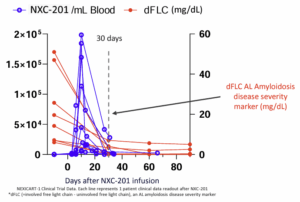

And indeed, data from the NEXICART-1 clinical trial revealed that “NXC-201 rapidly eliminates diseased AL amyloidosis plasma cells and exits within ~30 days”:

NEXICART-1 is an ongoing Phase 1b/2a clinical trial in Israel.

A separate Phase 1b/2a clinical trial in the U.S. — NEXICART-2 — is a more refined study that’s limited to patients with adequate cardiac function and who have not been exposed to similar therapies.

The lead clinical site is the prestigious Memorial Sloan Kettering Cancer Center under principal investigator Dr. Heather Landau, the Amyloidosis Program Director at the center, who has authored more than 100 peer-reviewed publications.

In June, IMMX announced that NXC-201 had met its primary endpoint with interim data indicating a complete response (CR) rate of 70% in NEXICART-2. These results were reported at the 2025 American Society of Clinical Oncology annual meeting.

Here’s an article from the prestigious Cleveland Clinic about the results.

Then in July, IMMX said it had accelerated NEXICART-2 clinical trial progress to include 18 clinical trial sites.

It also said that month that NXC-201 was showing a “class-leading safety profile.” That is a strong selling point in the CAR-T / cell therapy space, where safety / toxicity is often the limiting factor.

Back in February, NXC-101 received a Regenerative Medicine Advanced Therapy (RMAT) designation from the FDA.

This designation “requires that a drug is an advanced regenerative medicine, targets a serious condition, with the potential to treat, modify, reverse, or cure, and preliminary clinical evidence has indicated that the drug has the potential to address these unmet medical needs.”

On the financing side, in July 2024, the company received a sizable $8 million grant from the California Institute for Regenerative Medicine to support the development of NXC-201.

The Institute’s vice president of therapeutics development commented: “This one-time therapy would be an innovative treatment for patients with AL Amyloidosis, and the preliminary data are encouraging.”

And last month, on September 9, IMMX announced a strategic investment from Goose Capital and former Tanox, Inc. CEO Dr. Nancy T. Chang, Goose founding member.

Dr. Chang and her team invented and developed drugs that have collectively generated more than $5 billion in sales.

Dr. Chang also joined the IMMX board of directors concurrent with her investment.

Beyond its impressive therapeutic candidate, IMMX has assembled an incredible team…

Its executives hail from the likes of Goldman Sachs, AstraZeneca, and Pfizer…

And its scientific advisory board boasts doctors with positions at Columbia University, Harvard Medical School, and Stanford Medicine.

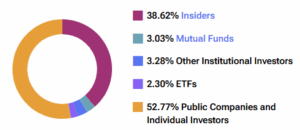

Company insiders seem confident. They’ve scooped up additional shares in June and again in September.

Overall, TipRanks reports that company insiders own a whopping 39% of the $82M market cap (estimated) company:

Source: TipRanks

Lastly, I should note that while only one firm is covering IMMX right now, it reiterated its BUY rating on September 12 with a 12-month price target of $8.00 — that’s more than 220% over Friday’s close.

Those are just some notes to get your own research started. If you want to look more into the company, check out the company website and especially the videos on this page. The company’s investor deck is also informative.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: Beginning October 3, IMMX broke out of a multi-month base on rising volume — exactly the kind of early momentum I like to see before a bigger push.

If it can stay above that $2.40 support zone, a move back toward the resistance at $3.00 looks to be on the table.

Keep a close watch on IMMX today to see where the likely market bounce-back takes it!

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received ten thousand dollars (cash) from Sica Media for advertising Immix Biopharma, Inc for a one day marketing program starting on October 8, 2025 and also twenty five thousand dollars for a one day marketing program starting on October 13, 2025. Prior to this, we received fifteen thousand dollars (cash) from Shore Thing Media for advertising Immix Biopharma, Inc for a one day marketing program on August 28, 2024, and also ten thousand dollars by ach bank transfer by Lifewater Media for advertising Immix Biopharma, Inc. from a period beginning on May 10, 2023 through May 10 of the same year. To date, we have received sixty thousand dollars for advertising Immix Biopharma, Inc.

It might seem obvious, but while our client claims not to own any shares in Immix Biopharma, Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Immix Biopharma, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.