Sponsored by Primetime Profiles and Disseminated on Behalf of KULR Technology Group, Inc*

TUESDAY Aug 19 , 2025

KULR Technology Group (NYSE: KULR)

👉KULR is TODAY’S #1 ALERT 👈

Hey Folks, Jeff Bishop here,

Today’s #1 trade alert is a stock I’ve officially inducted into the “tactical” idea Hall of Fame. 🏆

When I alerted it in mid-March last year, it went on to rip 150% in three weeks.

Then, when I alerted it again on December 10, it roared 365% before the month was through!

💥Go ahead and pull up KULR Technology Group (KULR) on your preferred trading platform.

You’ll see that the stock has drawn back a good bit since late December, though with some notable runups along the way.

That’s due in large part to the company pursuing a Bitcoin treasury strategy in parallel to its other operations…

The company began an at-the-market (ATM) equity offering agreement in July 2024 worth up to $20 million and expanded it in December 2024 to $26 million.

By March 27 of this year, the company had “issued 19,387,610 shares of common stock for gross proceeds of $51,122,190 under the ATM.”

And on June 9, it announced a $300 million ATM offering to invest in its Bitcoin treasury.

The company also announced a 1-for-8 reverse split on June 13 that went into effect June 23, and says the idea was to attract institutional investors and not due to compliance issues.

Last Thursday, August 14, the company reported it held “over 1,035 BTC and a yield approaching 300%.”

With the right catalyst, I think KULR could be primed for a breakout from here.

Let me explain…

In the past, KULR has been focused on advanced thermal management and energy storage solutions, and it’s still moving forward in those areas, as I’ll cover later.

But on December 4, the company announced a new Bitcoin treasury strategy, committing to allocate up to 90% of its surplus cash to BTC.

On December 26, KULR purchased 217 BTC at an average $95.6k each for a total of $21 million.

Since then, the company has purchased more Bitcoin nearly every month, and as mentioned, it now holds 1,035 BTC — worth approximately $120 million at today’s prices

According to this ranking, KULR is now the 39th top company “hodling” BTC.

In an interview with Bitcoin News in May, CEO Michael Mo explained that he “was convinced about the strategy after I listened to MicroStrategy’s Q3 2024 earnings call.”

He now says that the company sits “at the cross-section of energy storage, AI, robotics, and Bitcoin.”

On July 8, KULR announced it had secured a $20 million credit facility with Coinbase Credit “to fund its strategic Bitcoin accumulation goals.”

And the next day, it revealed the “successful deployment of 3,570 Bitmain S19 XP 140T Bitcoin mining machines at facilities located in Asuncion, Paraguay, thereby boosting the Company’s operational capacity to 750 petahash per second (PH/s).”

It said its goal was to increase that rate 66% by later this summer.

Bitcoin reached its all-time high of $124,000 last Thursday, August 14, and has pulled back from there to about $115,600.

That Friday, CoinDesk noted that while other digital asset treasury firms “plunged” along with the Bitcoin price, KULR broke from the trend:

“KULR Technology (KULR) gained over 5% after reporting second quarter revenue growth of 63% year-over-year, the highest in its history, driven by its bitcoin-first balance sheet strategy.”

Bitcoin.com wrote that, for Q2 2025, “Earnings of $8.14 million, or $0.22 per share, marked a sharp turnaround from last year’s $5.89 million loss.”

I’m watching to see if these solid earnings will propel KULR higher today, especially if we see a bounce-back in the Bitcoin price, and that’s why

👉 KULR is TODAY’S #1 ALERT 👈

Even apart from the company’s foray into Bitcoin, it is having one breakthrough after another.

CEO Michael Mo says the company is “building a new energy management platform for space, electrification, and the AI economy.”

That platform includes “comprehensive solutions in thermal interface materials, lightweight heat exchangers, and protection against lithium-ion battery thermal runaway propagation.”

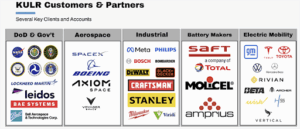

Its customers and partners include some of the biggest names in the aerospace, automotive, and defense industries…

We’re talking heavyweights such as NASA, the Department of Transportation, the Federal Aviation Administration, SpaceX, Tesla, Toyota, Raytheon, and Lockheed Martin.

The company has a strong focus on battery technology, and its storage and transport system for lithium-ion batteries has been used by NASA in crewed space vehicles since 2019.

The Battery Systems Lead at NASA, Dr. Eric Darcy, has said that “KULR’s solution is the lightest weight battery heat sink option NASA has evaluated to date.”

And the Senior Thermal Systems Engineer at NASA’s Jet Propulsion Laboratory said that “The KULR team has been an essential part of many of our projects in the last two decades.”

KULR says that it offers “our commercial customers the same technology that we provide to NASA protecting the ISS and its astronauts.”

As I say, the company has been up to a lot of incredible things over the past year, so here is just an outline. I encourage you to click on the links for more details.

2024:

- March 14: The company was awarded an $865,000 contract from Nanoracks, part of Voyager Space’s exploration segment to help with the “development, testing, and early production of a specialized space battery.”

- March 19: Announced a collaboration with “a leading U.S. automaker” that will focus on “mitigating thermal runaway risks in EV battery modules.”

- March 21: Revealed “the receipt of an additional purchase order from the United States Army, increasing the total contract value to $1.81 million for “the development of next-generation battery solutions for advanced aviation applications.”

- March 26: The company received “a six-figure contract from Lockheed Martin for developing phase change material (“PCM”) heat sinks that are pivotal for the thermal regulation of essential electronics within long-range precision missiles.”

- April 23: Announced “it has delivered on an immediate basis, a power cell battery deployment order for AI-enabled drone and advanced air mobility missions in Ukraine.”

- May 2: The company said it “recently leveraged its battery production capabilities at its newly instituted Webster, Texas facility to support NASA with rapid technical aid and production assistance to help prepare the administration’s R5 flight battery for its quickly approaching Firefly mission.”

- May 13: KULR announced “the launch of the KULR Online Marketplace, which features the Safe-X product line, including SafeCASE models and SafeSLEEVE products” which have “received United States Department of Transportation (DoT) approval under a special permit and are accepted by United Parcel Service for transporting batteries.”

- May 29: Revealed “a contract from a top Japanese multinational automaker … for testing and analysis of high-energy battery cells intended for their next-generation electric vehicles.”

- July 8: The company was awarded “a purchase order exceeding $400,000 from the National Aeronautics and Space Administration (“NASA”) … as part of a $2M multi-phase agreement for its advanced automated battery cell screening system.”

- September 25: KULR announced that “the Army will expand its battery contract with [KULR] to $2.4M.”

- October 2: The company struck “a licensing agreement for its proprietary vibration reduction technology named KULR Xero Vibe” with a leading Japanese corporation that specializes in advanced semiconductor solutions. “The $2.35M landmark deal includes a $1.1M minimum guaranteed license and royalty fee, a unique opportunity for the licensee to purchase proprietary balancing equipment directly from KULR and additional revenue upside to KULR based on volume and technology upgrades.”

- November 25: The U.S. Navy awarded KULR a contract “to advance its Internal Short Circuit (ISC) technology to activate at higher temperatures.”

- December 3: Reported “the immediate availability of NASA-certified M35A battery cells, qualified for use in JSC 20793-compliant battery packs.” The company also said it was “integrating the M35A into its proprietary 400 Wh K1 Space battery, a cutting-edge solution designed to meet the demands of human space exploration.” The battery was scheduled for completion in January “with a formal review by the NASA safety boards to follow shortly thereafter.”

- December 10: Launched its KULR Xero Vibe solution integrated with the NVIDIA Jetson edge AI platform, which the company says will “enable high-performance, reliable operation in edge AI environments” by addressing key challenges such as “vibration suppression, ensuring optimal cooling system performance, reduced energy consumption, and extended mechanical lifespans.”

- December 17: Announced its plans to launch the KULR ONE Space (K1S) battery in a lightweight satellite “via launch integrator Exolaunch on a SpaceX rideshare mission scheduled for 2026.”

2025:

- January 14: Announced the signing of a multi-million-dollar licensing agreement with a new partner “to enable advanced carbon fiber cathode applications for nuclear reactor systems in Japan.”

- January 22: Revealed a collaboration with the prestigious Scripps Research Institute’s Baran Lab which “developed a groundbreaking pyrolytic carbon (PC) electrode material, poised to transform synthetic organic electrochemistry.” KULR’s CEO said it “has the potential to redefine how we approach large-scale chemical synthesis.”

- March 13: We learned that “a prominent private U.S. space company has acquired its NASA-certified M35A battery cells for integration into their spaceflight programs.”

- April 15: Launched a strategic partnership with German Bionic to help develop AI-powered exoskeletons for the U.S. workforce.

- April 22: The Texas Space Commission awarded KULR with a $6.7 million grant “to develop cold-temperature lithium-ion battery solutions for the next generation of Lunar and Martian missions.”

Again, I’m only scratching the surface of this remarkable company. As you do your own research, be sure to study the company’s very accessible website as well as its August 14 earnings call/investor presentation.

For an even deeper dive, you can check out the company’s X and Instagram accounts and watch presentations from its recent “open house” on its YouTube channel.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: With KULR now among the top companies holding Bitcoin, and with it reporting record quarterly earnings, I’m looking to see how investors react to KULR today.

💥Tune into KULR to see if this will be another banner day for this “tactical” Hall-of-Famer!

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, We received five thousand dollars (cash) from Primetime Profiles for advertising KULR Technology Group, Inc for a one day marketing program on August 19, 2025. Additionally, we received five thousand dollars (cash) from Primetime Profiles for advertising KULR Technology Group, Inc for a one day marketing program on July 10, 2025. In addition to this, we received thirty thousand dollars (cash) from Shore Thing Media for advertising KULR Technology Group, Inc for a one day marketing program on April 10, 2025. Before this, we received twenty five thousand dollars (cash) from Shore Thing Media for advertising KULR Technology Group, Inc for a one day marketing program on March 28, 2025, and before that, we received twenty five thousand dollars (cash) from Shore Thing Media for advertising KULR Technology Group, Inc for a one day marketing program on February 20, 2025. Previously, we received ten thousand dollars (cash) from Shore Thing Media for advertising KULR Technology Group, Inc for a one day marketing program on February 5, 2025, and also ten thousand dollars (cash) from Shore Thing Media for advertising KULR Technology Group, Inc for a one day marketing program on January 14, 2025 and also, twenty five thousand dollars (cash) from Shore Thing Media for advertising KULR Technology Group, Inc for a one day marketing program on December 27, 2024. Before that, we received twenty five thousand dollars (cash) from Shore Thing Media for advertising KULR Technology Group, Inc for a one day marketing program on December 10, 2024 and also twenty thousand dollars from Shore Thing Media who was compensated by a third party not affiliated with the Company for advertising KULR Technology Group, Inc from a period beginning on for a one-day marketing prog. It might seem obvious, but while our client claims not to own any shares in KULR Technology Group, Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into KULR Technology Group, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.

Get LIVE Commentary On Our Hottest Trades!