Sponsored by Sica Media and Disseminated on Behalf of Tiziana Life Sciences*

Monday Aug 11 , 2025

Tiziana Life Sciences (Nasdaq: TLSA)

👉TLSA is TODAY’S #1 ALERT 👈

Good morning, Folks,

Stock futures are edging higher again this morning, marking the start of what I hope will be another strong week for the markets.

I’m laser-focused right now on a stock that has been very good to us in the past.

I actually alerted it three times back in January, and I hope you paid attention because on those days it surged 10%… 23%… even 28%.

While those were great moves, it’s what the stock has done since then that’s even more remarkable.

Since the start of February, it has climbed 218%!

💥Go ahead and pull up Tiziana Life Sciences Ltd (TLSA) on your favorite trading platform.

You’ll see that the stock has had a great run-up, especially since April, as “Liberation Day” fears abated.

It also hit a big inflection point in mid-July. That’s when Simply Wall St. named it a “promising penny stock to watch” and gave it a “★★★★★★” financial health rating.

From July 15 through the end of the month, TLSA ripped 70%. It pulled back a bit from there to kick off August, but on Thursday, it began another uptrend.

It jumped more than 5% on Friday, and with positive action in the pre-market, I’m watching this one today to see where the momentum takes it.

👉 TLSA is TODAY’S #1 ALERT 👈

Here are some things that jumped out at me that help explain why the stock has done so well this year…

Tiziana Life Sciences Ltd is a clinical-stage biopharmaceutical company developing breakthrough therapies for neuroinflammatory and neurodegenerative diseases with high unmet needs.

Its lead candidate, foralumab, is a monoclonal antibody therapy that reduces inflammation by targeting a protein on T cells called CD3.

One of TLSA’s key innovations is to administer foralumab intranasally, producing minimal toxicity while creating local T cells that more easily cross the blood-brain barrier.

The upshot is that foralumab may help suppress the activation of the brain’s most prominent immune cells — called “microglial cells” — which are overactive in diseases such as multiple sclerosis and Alzheimer’s.

While there are other therapies that target CD3, foralumab is the only CD3-targeting monoclonal antibody that is “fully human.” In theory, this should minimize adverse immune responses.

A similar anti-CD3 molecule that is only “humanized,” Teplizumab, was acquired in March 2023 by French pharma giant Sanofi for $2.9 billion.

Already, foralumab has shown incredible promise at reducing microglial activation.

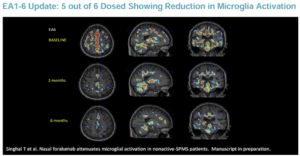

In April 2024, TLSA presented data at the annual meeting of the American Academy of Neurology showing that nasal foralumab “exhibited a reduction in microglial activation and disease stabilization in non-active secondary progressive multiple sclerosis [na-SPMS] patients … as observed through positron emission tomography (PET) imaging.”

Dr. Tarun Singhal, an associate professor at Harvard Medical School, authored the study, noting that it “provides initial evidence that this fully human anti-CD3 has the potential to benefit this type of MS, which is the most difficult form to treat.”

Those findings were reinforced when the company announced in June 2024 that “80% of the na-SPMS patients who received intranasal foralumab treatment for at least 6-months have a qualitative reduction of microglial activity” as confirmed in PET images.

Furthermore, 70% of patients experienced a meaningful reduction in fatigue scores, and stability of disease was noted within six months in all ten na-SPMS patients.

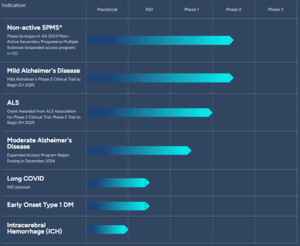

In May 2024, TLSA applied for Orphan Drug Designation for intranasal foralumab for the treatment of na-SPMS, and in July 2024, the FDA granted it a Fast Track Designation for treatment of the disease.

Fast Track will provide TLSA with an expedited review process and increased interaction with the FDA.

In December 2024, the Company dropped big news of an expansion of their Phase 2 trial to include trial sites at prestigious institutions such as:

- Yale University

- Johns Hopkins University

- Cornell University

- University at Buffalo (SUNY)

- University of Massachusetts (UMass)

- Thomas Jefferson University

In May 2025, TLSA revealed promising results from its Phase 2 trial for na-SPMS that demonstrated “nasal foralumab was safe, induced potent regulatory immune responses, reduced microglial activation, and stabilized clinical progression in patients suffering from progression independent of relapse activity.”

But na-SPMS isn’t the only potential indication for foralumab…

TLSA has also received Investigational New Drug clearance from the FDA for foralumab as a treatment for Alzheimer’s, and in September 2024, the company announced a prestigious $4 million grant from the National Institutes of Health to Dr. Howard Weiner as principal investigator at Brigham and Women’s Hospital to study nasal anti-CD3 for the treatment of Alzheimer’s disease.

In February of this year, the ABC affiliate in Boston aired a segment that featured the “Massachusetts man first to try new Alzheimer’s nasal spray treatment [foralumab]” as well as an interview with Dr. Weiner.

And in May, TLSA announced publication of a study in the journal Clinical Nuclear Medicine showing “intranasal administration of foralumab significantly dampened microglial activation in a 78-year-old patient with moderate Alzheimer’s disease.”

On July 21, it announced “profound immune modulatory effects” in the patient.

“Encouraged by these results and the observed behavioral improvements reported by the patient’s family, the patient and his wife have chosen to continue nasal foralumab therapy for an additional 6 months.”

TLSA is also investigating the foralumab’s effectiveness for Long Covid, which is estimated to cost the US healthcare system almost $2.6 trillion. It announced in February that it expected its preclinical Long Covid study to be completed in Q2 2025.

In October 2024, the company dropped huge news:

The study — conducted by Dr. Howard Weiner and Selma Boulenouar PhD, and a research team at Brigham and Women’s Hospital in Boston — found that “Nasal anti-CD3 in combination with semaglutide [Ozempic] demonstrates synergistic effects in promoting liver homeostasis in preclinical models of diet-induced obesity.”

It also found that “The combination significantly reduces inflammation markers, a key factor in obesity-related metabolic disorders.”

In January of this year, TLSA announced that its research “demonstrates that nasal anti-CD3 not only amplifies the beneficial effects of GLP-1 agonists but now also would potentially sustain these benefits even after discontinuation, providing a novel and non-toxic approach to maintaining tissue homeostasis and improving patient outcomes.”

As I’m sure you’re aware, Ozempic is perhaps the hottest drug on the market right now, and these findings suggests TLSA’s drug candidate may be a powerful complement to it.

In November 2024, the company revealed it was awarded a prestigious grant from the ALS Association to fund a 20-patient clinical trial of intranasal foralumab as a treatment for Amyotrophic Lateral Sclerosis (ALS), better known as Lou Gehrig’s disease.

It March of this year, TLSA filed an IND application for a phase 2 clinical trial in ALS.

TLSA’s pipeline for foralumab.

Dr. Matthew W. Davis, chief medical officer of TLSA, notes that, “We have now seen the potential of intranasal foralumab to dampen microglial activation in three major neuroinflammatory-related diseases, which creates significant optionality for exploring its benefits in some of the most important and burdensome medical conditions of our time.”

These developments help explain why on May 12 TLSA founder and executive chairman Gabriele Cerrone purchased 15,000 common shares of company stock, “bringing his total holding to 43,252,143 common shares, which is 37.02% of issued share capital.”

And also why on July 22, Lucid Capital initiated a BUY rating with an $8.00 price target — 263% higher than Friday’s closing price.

Those are some notes on TLSA to jumpstart your own research. You should check out the company’s very informative website, and you may want to review this investor presentation from August 2024.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: TLSA’s stock has roared 223% higher YTD. It had a brief retracement to kick off August but it began climbing again on Thursday. With positive action in the pre-market, I’m locked into TLSA today to see where this momentum takes it.

💥Put TLSA at the top of your watchlist right away!

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we were paid twenty five thousand dollars from Sica Media for a one day marketing program on August 11, 2025. Additionally, we were paid thirty five thousand dollars directly from Tiziana Life Sciences Ltd for a one day marketing program on January 22, 2025. Before this, we received ten thousand dollars cash from Shore Thing Media for a one day marketing program on January 15, 2025. Prior to this, we were paid thirty five thousand dollars directly from Tiziana Life Sciences Ltd for a one day marketing program on January 10, 2025, and another thirty five thousand dollars directly from Tiziana Life Sciences Ltd for a two day marketing program on December 16-17, 2024 and also thirty five thousand dollars directly from Tiziana Life Sciences Ltd for a one day marketing program on December 4, 2024, and also thirty thousand dollars directly from Tiziana Life Sciences Ltd for a one-day marketing program on October 30, 2024. We also received seventeen thousand five hundred dollars (cash) from Interactive Offers for advertising Tiziana Life Sciences Ltd for a one day marketing program on June 6, 2024. Before that, we were paid seventeen thousand five hundred dollars (cash) from Interactive Offers for advertising Tiziana Life Sciences Ltd for a one day marketing program on April 22, 2024 It might seem obvious, but while our client claims not to own any shares in Tiziana Life Sciences Ltd, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Tiziana Life Sciences Ltd might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.

Get LIVE Commentary On Our Hottest Trades!