Sponsored by Sica Media*

Monday June 16, 2025

Knightscope, Inc (Nasdaq: KSCP)

👉KSCP is TODAY’S #1 ALERT 👈

Hey Folks, Jeff Bishop here with a quick “tactical trade” idea for you.

This is a company that posted solid Q1 earnings, dramatically improving year-over-year and beating estimates.

In April alone, it announced new revenue exceeding Q1 entirely, and its stock has done very well as a result.

Coming out of the stock market’s low on April 9, it has surged more than 120%, outpacing the S&P 500’s recovery six-fold.

If you’ve been following along, I’ve had great success lately identifying momentum plays that had bested the S&P’s bounce-back, and this stock has done that in spades.

💥 I’m dialed into Knightscope, Inc. (KSCP)

today, and suggest you put it at the very top of your radar right away. 💥

👉 KSCP is TODAY’S #1 ALERT 👈

Knightscope, Inc. (KSCP) is a Silicon Valley-based robotics and AI company with a vision to transform the public safety industry in the U.S.

In fact, it is already doing so, with nearly 10,000 machines-in-network deployed across the country in venues such as airports, casinos, college campuses, public parks, and hospitals.

Established in 2013 in the wake of the Sandy Hook school shooting, the company is widely considered the “first mover” in security robots, and over the years its clients have included major airports, corporations, and now even the U.S. federal government.

To date, its robots have operated 3+ million hours, working 24 hours a day and 365 days a year. It turns out robots don’t care much about holidays!

A January 2024 article in Forbes described KSCP as the “current market leader” in security bots.

According to KSCP, the goal of its robots is not to replace police officers or security guards, but to augment them with “superhuman capabilities” such as facial recognition, thermal scanning, people detection, and automatic license plate recognition.

The company offers a variety of robots, including stationary towers, entry scanners, and mobile robots for indoor and outdoor use.

Knightscope: Hardware + Software + Humans

KSCP is a dynamic company, and almost as impressive as what it has accomplished is where it sees itself going…

Its vision includes deploying 1 million networked machines — including “autonomous security robots, blue light emergency towers, e-phones, call boxes, aerial drones, autonomous patrol vehicles, quadrupeds, humanoids and other future technologies” — leveraging physical AI to transform the security landscape.

The company even ran an impressive marketing program that included a “robot roadshow” that had made over 100 stops nationwide to allow prospective clients to experience Knightscope’s technologies up close.

Here’s a quick video showing a roadshow stop in Los Angeles.

KSCP operates on a Machine-as-a-Service (MaaS) model, which generates recurring revenue through subscription-based contracts for its robots and services.

On the financial front, on May 14, KSCP reported Q1 2025 net revenue of $2.9 million, up from $2.3 million in Q1 2024, and a gross margin loss of 23% compared to 64% in Q1 2024.

The company also reported $12.7 million in cash and cash equivalents at the end of the quarter, up 14% from the end of Q4.

The company is increasingly angling for government contracts…

In late April 2024, it presented to members of Congress at the Hart Senate Office Building and announced compliance with the Buy America and the Buy American Act, which will open the company to considerable federal funding.

The next week, KSCP revealed that one of its robots “is patrolling on a U.S. Department of Veterans Affairs property. …. opening the door for new stakeholders to begin evaluating the use of Knightscope technologies among other federal departments and agencies.”

This January, it partnered with the U.S. Air Force “for a Phase I SBIR contract to streamline and improve Air Force Installation Security procedures and outcomes.”

The partnership “aims to leverage Knightscope’s Autonomous Security Robots (ASRs) to improve the safety of critical defense assets and personnel while solving the Air Force’s most urgent security challenges.”

And in February, KSCP received full FedRAMP® authorization through an ATO (Authority to Operate), enabling “broader deployment of the company’s autonomous security solutions across federal agencies.”

It established operations in D.C. that same month and began working with strategy firm Washington Office to “expand Knightscope’s capacity to deliver advanced security solutions to the federal government.”

In a big move in April, KSCP secured a new 33,000 square foot headquarters in Silicon Valley that more than doubles the company’s previous space, “enabling accelerated growth across engineering, manufacturing, and client support.”

That same month, it announced $3.2 million in new sales, beating its Q1 revenue in a single month. And in June, it revealed another $1 million in new contracts.

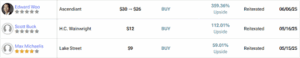

As mentioned, the stock has surged since April, but analysts still see considerable upside from here:

Note that those price targets were all reiterated in the past month.

As you do your own research on KSCP, check out this impressive investor deck (which I highly recommend checking out) and check out the company’s website and its 52,700-follower X account.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received fifteen thousand dollars (cash) from Sica Media for advertising Knightscope, Inc for a one day marketing program starting on June 16, 2024. Prior to this, we received twenty five thousand dollars (cash) from Sica Media for advertising Knightscope, Inc for a one day marketing program starting on July 19, 2024. Before that, we received seventeen thousand five hundred dollars from Shore Thing Media for advertising Knightscope on April 24, 2024. It might seem obvious, but while our client claims not to own any shares in Knightscope, Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Knightscope, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities br0ker-deale.r, br0ker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.