Sponsored by Sica Media and Disseminated on Behalf of Foremost Clean Energy*

wednesday July 16, 2025

Foremost Clean Energy (Nasdaq: FMST)

👉FMST is TODAY’S #1 ALERT 👈

Hey Folks, Jeff Bishop here.

With all the talk about Iran’s nuclear program and new nuclear projects in the U.S., uranium has been at the top of my mind.

That’s also because one of the stocks I’ve alerted many times this year has had some great price action.

💥Foremost Clean Energy Ltd. (FMST) — a uranium and lithium exploration company — roared nearly 800% from April 25 to June 5.

One of my alerts was on the morning of Monday, May 12. Here’s how it looked by the end of the day:

By the end of that week, it had increased by 164% from my initial alert.

I alerted it again on June 4, and by the following day, it had climbed 31% from my alert.

And then there was my alert from June 25. By the next day, it reached a 12% gain.

There has been some profit-taking from there, and the stock is back at a level that I think is worth considering again.

As you’ll see, there are powerful tailwinds at its back…

A huge one is the series of executive orders President Trump signed on May 23 that generated this headline in the Wall Street Journal:

The President “outlined plans to overhaul the U.S. nuclear regulator, fast-track licenses for new projects, boost domestic fuel supplies and use federal lands for reactors for the military or large data centers for artificial intelligence.” [emphasis added]

The White House said the executive orders would “usher in a nuclear renaissance.”

And indeed, on June 23, we learned “New York governor seeks to build the state’s first new nuclear power plant in decades” with the goal of increasing the state’s nuclear capacity by about 25%.

These bold ambitions will clearly require a reliable supply of uranium.

Adding to demand, more than 20 countries, including the U.S., have signed a pledge to help triple nuclear energy capacity globally by 2050.

On June 1, The Guardian covered how the “Tide is turning in Europe and beyond in favour of nuclear power.”

The demand for nuclear energy is driven in no small part by the rise of energy-intensive technologies such as crypto mining, AI, and data centers.

The tech titans — think Meta, Amazon, Google, and Microsoft — are considering the deployment of Small Modular Reactors (SMRs) to power their energy-intensive projects, which would mean a serious boost in uranium demand.

In fact, just in May, Google signed an agreement with a nuclear developer for three 600-megawatt advanced reactors.

On June 3, the Wall Street Journal reported that “Meta Signs Nuclear Power Deal to Fuel Its AI Ambitions.”

On the supply side, we got this article from the Financial Times earlier this year:

The predictable result is that the uranium price is up 14% since its March low. On a longer timeframe, if you compare it to July 2020, it’s up 131%.

And on June 20 of this year, Sprott Physical Uranium Trust (SPUT) announced a $200M deal to acquire physical uranium.

With SPUT hoarding physical uranium, high-grade explorers in the Athabasca Basin like FMST find themselves very well positioned.

Now is clearly a great time to be in the uranium space!

With all the news about nuclear energy continuing to pile up, FMST is at the very top of my radar.

💥Stay tuned to this “tactical trade” Hall of Famer 🏆 as the day unfolds.

👉 FMST is TODAY’S #1 ALERT 👈

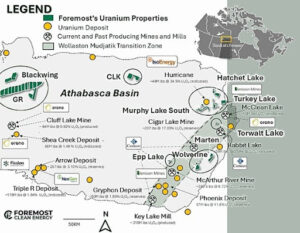

The company itself holds a diversified portfolio of 10 properties in the Athabasca Basin, the world’s richest uranium region, with grades 10 to 100 times higher than the global average.

One competitive advantage FMST has is its partnership with uranium producer Denison Mines Corp (NYSE American: DNN & TSX: DML), which gave FMST the option to acquire up to a 70% interest in 10 uranium exploration properties.

This is a total game changer. Denison — “a clear leader in the uranium sector” — now holds ~16% of FMST’s shares outstanding, and their president and CEO, David Cates, sits on FMST’s board.

Denison also provides FMST technical/financial backing — de-risking exploration while offering direct access to their uranium expertise and vast industry network. It’s clearly vested in its new partner’s success.

The 10 properties span over 330,000 acres located in the Athabasca Basin in Saskatchewan, Canada, an area “with robust infrastructure and known to host some of the world’s richest uranium deposits producing ~15% of world’s primary uranium supply, where grades routinely hit 10-100X global average!” It’s often called the “Saudi Arabia of Uranium”!

Foremost’s properties, surrounded by uranium mines and mills

As a bonus, FMST maintains a portfolio of lithium projects at varying stages of development with extensive past drilling, located across 55,000+ acres in Manitoba and Quebec — giving investors battery metals exposure without dilution.

In March, FMST announced a $6.5 million fully-funded exploration program — to begin in 2025 — on its diverse portfolio within proven uranium corridors surrounding or near some of the world’s largest and highest-grade uranium operations, including the McArthur River and Cigar Lake mines.

FMST confirmed multiple drill programs will turn in 2025 on drill-ready and permitted targets, positioned along strike of recent high-grade discoveries providing investors de-risked exploration within a tier 1 district.

Denison, thanks to its years of previous exploration, including drilling and geophysical surveys, is providing FMST a validated roadmap, enabling high- potential targeted drilling on mineralized zones and providing FMST a clear competitive advantage from the outset.

In April, FMST commenced drilling at the Hatchet Lake Uranium Project.

But the biggest news came on May 1 when the company announced “Highly successful initial results from Foremost’s inaugural drill program at the Hatchet Lake Uranium Property,” including “a NEW discovery of uranium mineralization.” [emphasis added]

They struck radioactive “gold”!

CEO Jason Barnard noted that “The Hatchet Lake discovery is a testament to the strategic value of our unique collaboration with Denison Mines – a rare advantage that allowed Foremost to build on years of high-quality exploration work. Unlike junior explorers starting from scratch, we immediately validated high-potential targets and uncovered new mineralization in our first program. With drilling ongoing, we’re now following up this discovery while testing additional targets identified through Denison’s groundwork. These results underscore the exceptional potential of Foremost’s uranium portfolio and the quality of our optioned Denison projects.”

FMST maintains a lean capital structure, with about 12 million shares outstanding. This, coupled with considerable insider and institutional support, creates a compelling entry point for investors looking to capitalize on its growth trajectory.

As you do your own research on FMST, be sure to take a look at this investor presentation released just last month as well as the company website.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: FMST went an absolute rocket ride — shooting up nearly 800% from April 25 to June 5. It’s now back at a level that I think is well worth considering.

💥Pay close attention to FMST as we watch all the action unfold!

To Your Success,

Jeff Bishop

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received thirteen thousand five hundred dollars (cash) from Sica Media for advertising Foremost Clean Energy Ltd for a one day marketing program starting on July 16, 2025. Additionally, we received twenty-five thousand dollars (cash) from Sica Media for advertising Foremost Clean Energy Ltd for a one day marketing program starting on July 2, 2025. Prior to this, we received thirty-five thousand dollars (cash) from Sica Media for advertising Foremost Clean Energy Ltd for a two day marketing program starting on June 4, 2025. Before this, we received $3750 (cash) from Shore Thing Media for advertising Foremost Clean Energy Ltd for a one day marketing program starting on May 20, 2025, and we also received thirty five thousand dollars (cash) from Sica Media for advertising Foremost Clean Energy Ltd for a two day marketing program starting on May 12, 2025, and also thirty five thousand dollars (cash) from Legends Media for advertising Foremost Clean Energy Ltd for a one day marketing program on March 4, 2025, and also we received fifteen thousand dollars (cash) from BullzEye Media for advertising Foremost Clean Energy Ltd for a one day marketing program on February 24, 2024. It might seem obvious, but while our client claims not to own any shares in Foremost Clean Energy Ltd, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Foremost Clean Energy Ltd might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full picture.

Get LIVE Commentary On Our Hottest Trades!